The cryptocurrency market has developed rapidly over the past few years, gaining the attention of both long-term investors and short-term traders. As it continues to grow, understanding the key factors that drive profitability has become increasingly crucial for traders who want to gain maximum returns. Despite the market’s volatility, cryptocurrency adoption has come a long way since its inception. This blog will discuss the market capitalization and trading volume in cryptocurrency. We will note how these metrics can be leveraged to optimize crypto trading strategies.

Market capitalization and its necessity

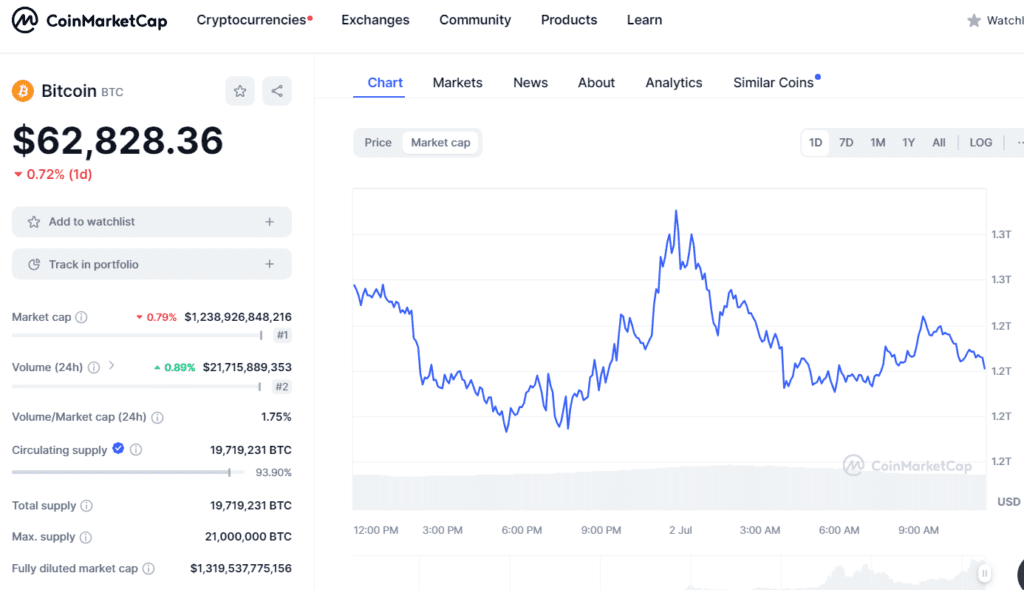

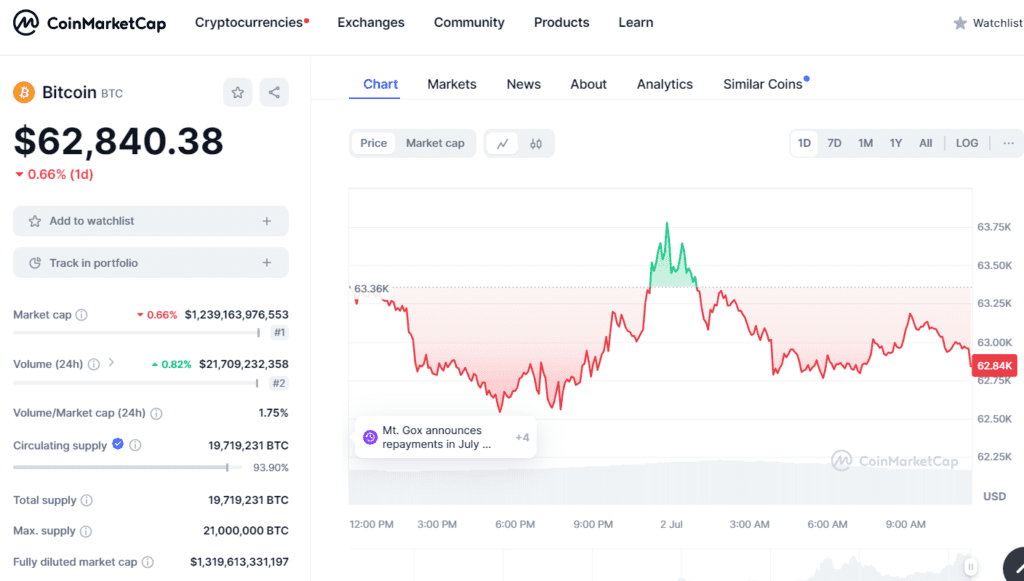

The total value of coins in circulation for a cryptocurrency refers to the market capitalization or market cap. Cryptocurrencies with a larger market cap are usually considered a more stable investment than those with smaller caps, which are more sensitive to market volatility.

We calculate market cap by multiplying the number of cryptocurrencies in circulation by the current price of a coin. For example, imagine an altcoin currently worth $100 with a circulating supply of 25 million. Multiplying these two factors will give us a market cap value of $2.5 billion.

Market caps help investors and traders compare the relative value of different cryptocurrencies. You don’t want to compare prices of two cryptocurrencies to see which one is more lucrative. XRP trading in single digit dollars does not mean it’ll perform better than Bitcoin at $60,000. Instead, it’s the market cap that can indicate a coin’s growth potential and risks compared to other coins. Of course, it’s also essential to consider the current market trends, coin stability, and personal financial situation before investing and trading in crypto.

Calculating market caps

There are three ways to calculate this factor.

- Circulating supply market cap

It tells us the number of crypto coins in circulation and multiplies it by the current price.

- Fully diluted market cap

It refers to the maximum number of coins that could be mined rather than just the market circulation supply.

- Total supply market cap

It considers the total number of coins mined, including those that may be locked up or reserved.

Types of market caps

- Large-cap (>$10 billion): This type of investment is considered low risk and demonstrates growth and high crypto market liquidity. It can handle more withdrawals without significantly impacting the overall cryptocurrency price.

- Mid-cap ($1 to $10 billion): It has more upside potential but is also prone to higher risks.

- Small-cap (<$1 billion): It is most susceptible to unexpected price fluctuations in the market.

Leveraging market cap to maximize profits

While trading in crypto, consider investing across various market cap tiers to balance risks and maximize long-term returns.

- Large-cap cryptocurrencies like BTC and ETH provide a stable foundation and more growth prospects than mid- or small-caps.

- Regularly adjust your crypto entries and exits to gain maximum benefits from surpassing small-caps and reinvest in large-cap assets.

- Pay close attention to market cap rankings and look for opportunities to invest early in promising small-cap before they show growth in mid- or large-caps.

Proper analysis of market cap data can help you make informed decisions and keep you updated on constantly evolving market trends. Millionero is an excellent place to start exploring the crypto trading platform quickly.

Crypto trading volume and its significance

Crypto trading volume is the total number of cryptocurrencies traded within a given period, i.e., usually 1 hour, 24 hours, 7 days, or 30 days. Investors assess trading volume based on the trades on all cryptocurrencies or a single exchange. The crypto trading volume is an indication of interest in a particular coin. The more people buy and sell crypto assets, the greater the volume. High crypto trading may indicate a price surge, whereas low volume could imply dipping prices. The trading charts usually show the volume as the number of coins, shares, or futures contracts.

- To calculate the total crypto trading volume, you must know the total crypto traded in a given time. For instance, the total amount of Bitcoin (BTC) traded in the last 24 hours is $10 billion. Therefore, the 24-hour trading volume of BTC will be $10 billion.

The trading volume in the crypto network is essential as it helps to identify a coin’s possible price fluctuations and market health. High trading volumes usually indicate bullish trends, which may be a great investment time. Several investors and experts consider that the currency’s highest trading volume usually translates to better stability and liquidity.

If you are new to cryptocurrencies, terms like crypto trading volume and market cap may seem too technical and intimidating. However, understanding these terms and concepts is crucial for successful trading. On the Millionero platform, staying informed about price fluctuations and monitoring market cap can positively impact your trading strategies.

Leveraging crypto trade volume to maximize profits

Analyzing cryptocurrency trading volume can be a powerful tool for traders and investors to maximize their profits. These points will help you manage your trades better.

- If investing in crypto, look for periods of high trading volume and increased prices. This is a likely sign of a further price surge.

- By closely monitoring the volume results over varied periods, one can identify patterns and emerging trends, spot potential breakouts, and more accurately and smartly time trade entries and exits.

- Similarly, lower trading volume with a price dip may indicate a red flag for a coin and a lack of selling pressure.

- Investors may remain cautious due to its low trading volume, even if a particular coin witnesses a sudden jump in its value by around 30%.

By using these analyses in the overall crypto trading strategy, you can get useful insights to make informed decisions and improve your profitability in the crypto market.

The bottomline on crypto trading

In crypto trading, market cap and trade volume are key metrics you want to look at, which give useful insights into the health and potential of the cryptocurrency market. Market cap tells about the overall value and stability of a specific currency, whereas trade volume reflects the amount of its circulation in a specific time frame and liquidity. Interested investors should leverage these factors to build diversified crypto portfolios and identify the trends and time limits to gain maximum profits. By understanding these two metrics, crypto enthusiasts can navigate the market confidently.

This is where Millionero helps beginners and expert traders trade easily on their platform. With all the updated crypto trading information, one can analyze and invest in crypto through Millionero. Read their blogs to stay updated and learn more about the crypto world.

Disclaimer: Cryptocurrencies are an inherently volatile asset class, and investments can carry substantial risks. This information is for educational purposes only and should not be construed as financial advice. Always do your own research and conduct due diligence before investing in crypto projects.