Bitcoin soars to $93K as Bitcoin ETFs gain massive attention, surpassing gold ETFs. With $70.9B in holdings, they now represent nearly 5% of all Bitcoin, showcasing growing confidence from institutional investors and pushing Bitcoin further into mainstream finance.

In crypto markets, money often moves in stages, starting with Bitcoin, then Ethereum, and eventually smaller altcoins. This time, however, there’s less movement into altcoins as many investors prefer stablecoins. For altcoins to grow in popularity, they may need more support from big investors and clearer regulations.

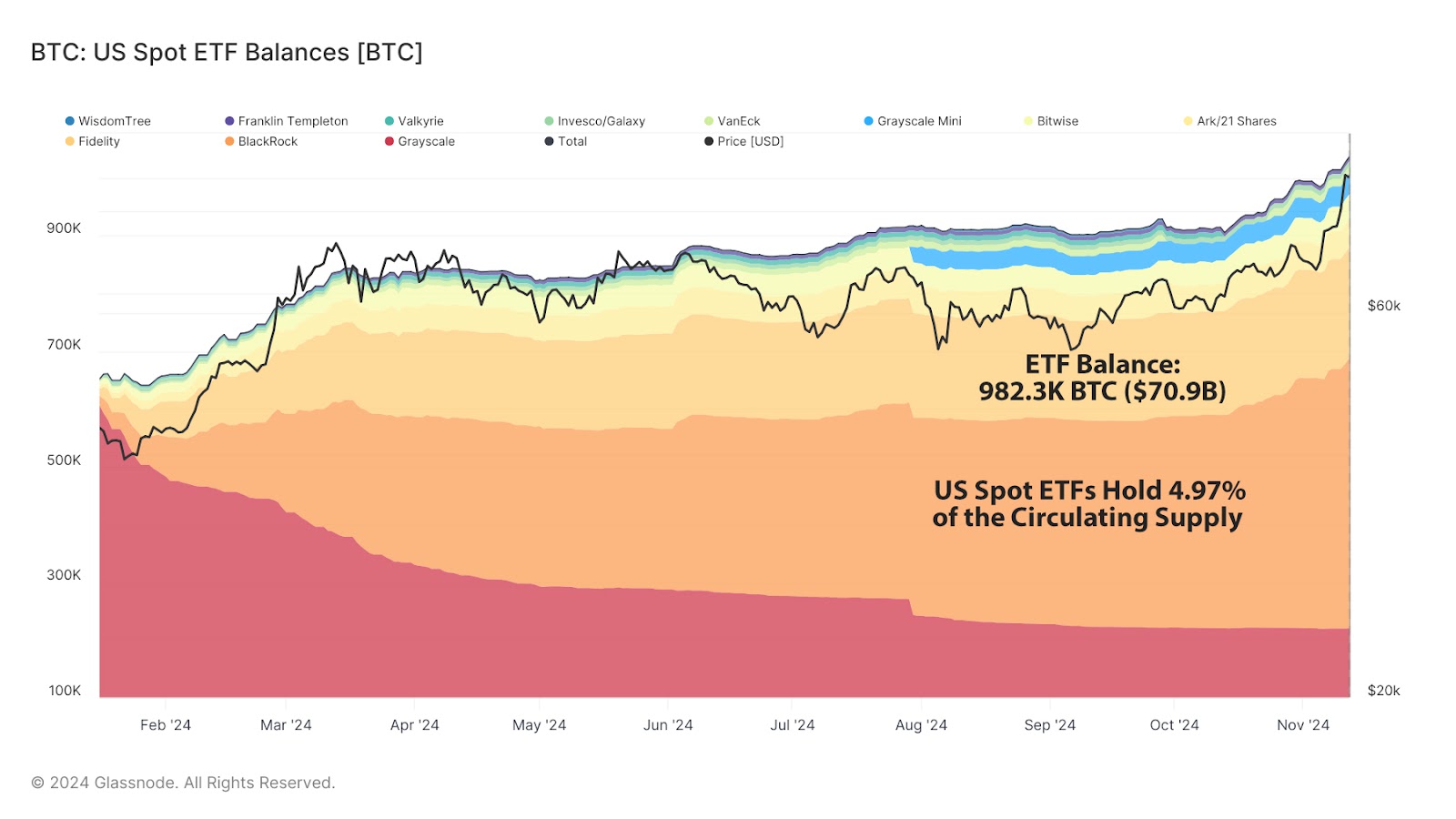

Overview of Bitcoin ETF Trends

Mainstream Investor Confidence in Bitcoin ETFs

According to a report from Glassnode, Bitcoin ETFs are seeing record inflows, indicating growing confidence from mainstream investors. Recently, spot Bitcoin ETF assets have outpaced those of gold ETFs, highlighting strong institutional interest. This surge elevates Bitcoin’s status as a credible asset in traditional finance, suggesting that ETF-driven liquidity will play a significant role in influencing market trends and price dynamics.

Source | Coinglass

Institutional Demand and Market Impact

Institutional demand for Bitcoin exposure has surged, with total assets managed across all BTC ETFs now reaching a market value of $70.9 billion. These ETFs collectively hold approximately 4.97% of Bitcoin’s circulating supply, reflecting substantial interest from institutional investors.

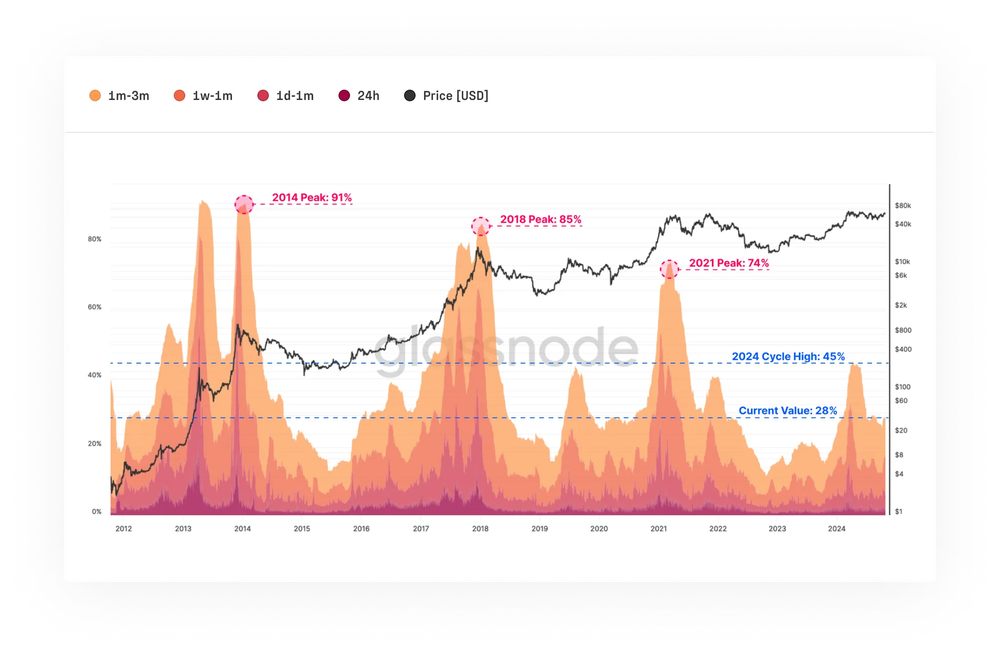

Historical Patterns and Market Cycles

Past trends suggest a strong possibility for continued growth. Analysis of market cycles reveals that, following previous Bitcoin all-time highs, crypto markets have typically entered prolonged periods of expansion. With Bitcoin’s latest peak, current indicators imply a similar stage in the cycle, presenting an ideal entry opportunity for institutions aiming to leverage ongoing bullish momentum.

New and Established Investors’ Influence on Market Dynamics

This trend is evident across both established and emerging markets, as seasoned investors distribute holdings to newcomers attracted by rapid price gains. Unlike previous all-time high distribution phases, the share of wealth held by new investors has not reached past peak levels, indicating this cycle may still have room to run.

Source | Coinglass

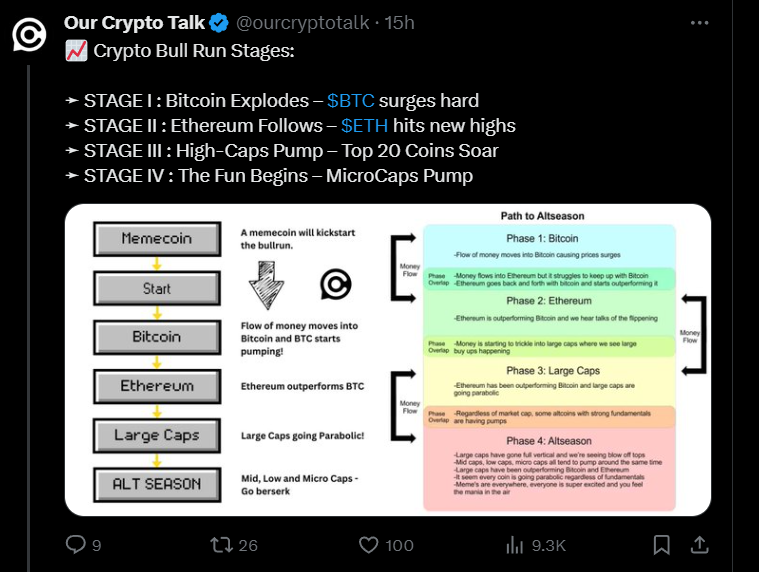

Capital Rotation into Altcoins

Source | X @ourcryptotalk

Capital rotation, where funds flow between different asset types, is a recurring trend in crypto markets. Historically, investors first pour money into Bitcoin during bull markets, followed by Ethereum and then smaller altcoins. This cycle reflects a “risk curve” where liquidity moves progressively from less risky assets like Bitcoin to higher-risk altcoins. During the 2021 bull run, significant capital moved into altcoins, creating gains and attracting retail investors. However, in the current cycle, stablecoins have become the preferred quote currency, showing increased stability and speculation in altcoin markets. The lack of substantial capital rotation into altcoins suggests that retail investors remain cautious or are reallocating funds into stable, USD-pegged assets.

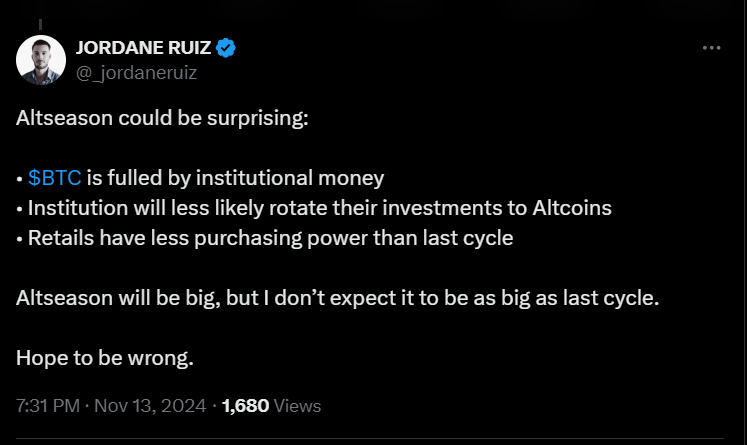

Institutional Trends and Altcoin Demand

Institutional investors have primarily been drawn to Bitcoin and, to a lesser extent, Ethereum. Other altcoins have not yet seen similar levels of adoption. ETFs and futures contracts focused on Bitcoin have brought substantial liquidity and credibility to the asset, further driving its dominance. Unlike Bitcoin ETFs, altcoins lack equivalent financial products, reducing their appeal to institutions. Additionally, altcoin trading largely remains within decentralized finance (DeFi) and centralized exchanges, making it challenging for mainstream institutions to engage.

Source | X @_jordaneruiz

Future Outlook for Altcoins

As the market matures, altcoins face both challenges and opportunities. Many protocols are focusing on real-world asset tokenization and decentralized applications, aiming to prove the utility beyond speculation. With increasing interest in decentralized finance and the tokenization of assets, certain altcoins might find renewed attention. However, altcoins will need broader institutional acceptance, regulatory clarity, and possibly new financial products, such as altcoin-focused ETFs, to capture significant market share in a Bitcoin-dominated space.

Final Thoughts

We are not financial advisors, and we encourage you to always do your own research (DYOR). Check out our blog at blog.millionero.com for more insights. If you’re ready to dive in, trade with us at Millionero, where you can explore both spot and futures markets!

The “Trump Bump Effect” on Bitcoin’s recent peak highlights how growing interest from big investors, especially through Bitcoin ETFs, is helping integrate Bitcoin into traditional finance. While Bitcoin is booming, the altcoin market sees slower movement, as many investors lean towards stablecoins over higher-risk assets. For altcoins to gain more traction, they’ll need support from big investors and clearer regulations. So, while Bitcoin remains dominant, the altcoin market has room for growth if it can attract institutional interest and regulatory support.