Crypto has become an investor favorite asset class in 2023, majorly influenced by its steady climb fresh out of the crypto winter of 20222. Bitcoin has surged by a wide margin in the current year, while other tokens have also staged price jumps. As crypto continues to evolve into a mainstream investment option for millions, trading crypto could hold enormous potential for those aiming to create massive wealth. As someone entering the market, however, it is natural to wonder how the pros got where they are today. The secret behind their gains is the use of crypto indicators.

In this article, we have compiled a list of the best indicators for crypto trading. However, let’s first learn why crypto indicators are such a core part of how crypto pros strategize.

Why are crypto indicators important?

Crypto indicators are visual or numerical depictions of the movements of crypto tokens. One can analyze crypto trading indicators based on past trends for the technical analysis of a token.

How can crypto indicators be helpful while trading? Crypto trading indicators are essential to analyze a token or the overall market before executing trades. The best indicators for crypto will help you understand the market’s sentiments, risks, volatility, or future prospects.

Here are a few reasons why trading indicators are so important for the experts in cryptocurrency trading:

Convenience and Efficiency: You can automate your trades with the best indicators for crypto. Your trades will improve efficiency while being extremely convenient.

Managing Risk: The crypto market is highly volatile, and no one, be it experts or beginners, is averse to its risks. Hence, the best indicators for crypto trading will help you mitigate such risks and trade cautiously while minimizing losses.

Increasing Profits: Conversely, the best indicators for crypto will help you identify opportunities in the market and increase your profits exponentially!

The best indicators for crypto trading

A list of the most essential crypto trading indicators used by expert crypto traders are as follows:

Price trends: Price trends of the crypto market or a particular cryptocurrency token are counted as one of the major crypto indicators. Such trends may involve a market moving upward during a rally or downward in case of sell-offs. On the other hand, a flat market could hint at stagnant movements across crypto tokens, helping you plan your trades accordingly.

Volume: This represents the amount of a certain crypto traded in a given period of time. Analyzing a crypto’s volume can give you insights into the strength or weakness of a price movement. For example, a higher volume in the past 24 hours during a rally can mean strong buying interest, while a higher volume in the same period of time during a downtrend may show a strong selling pressure.

Moving Average: One of the best indicators for cryptocurrencies, moving averages (MA), defines a crypto asset’s cumulative average price over a definite period. Usually, crypto traders track an asset’s 20-day or 50-day moving averages for short-term trades.

The time period could go up depending on the trader’s strategy. MA mainly aids in leveling an asset’s price data by mitigating short-term price fluctuations.

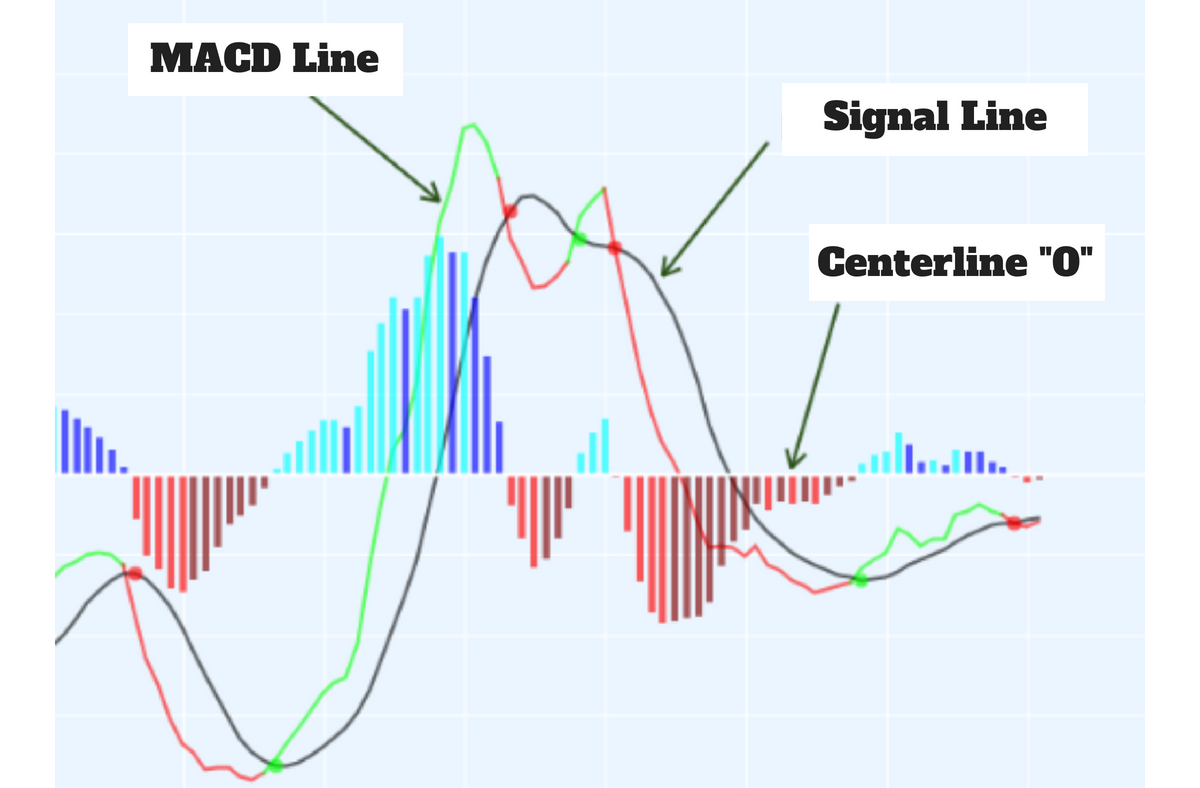

Moving Average Convergence Divergence (MACD): The MACD crypto indicator consists of four parts: the signal line, zero line, MACD line, and histogram. The MACD of a crypto asset could hint at crypto traders to buy or sell the asset depending on the signal line and the MACD line’s movements.

The MACD line going above the signal line points to bullish sentiments, while the opposite signals a bearish scenario.

Candlestick patterns: Candlestick patterns are one of the most common cryptocurrency indicators. The color, body, and shadow or wick of these patterns are representations of various metrics of a crypto asset. A single candle stands for a single trading day, while a pattern of these candles can denote a more extended time period. Popular candlestick patterns include inverse hammer, doji, spinning top, and others.

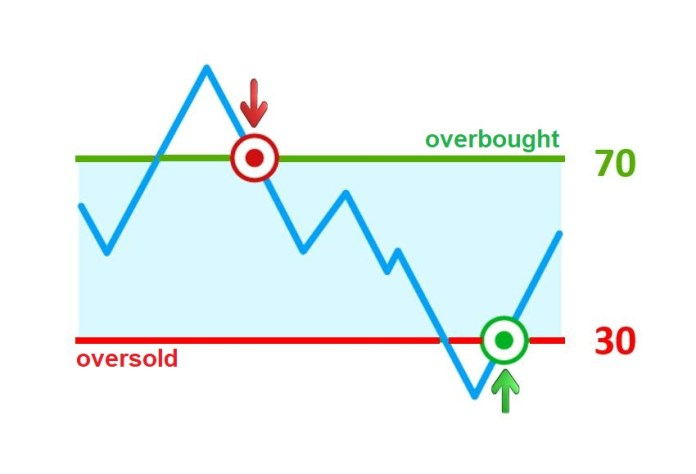

Relative Strength Index (RSI): The RSI of a token notes whether it is trading over its actual value or if it is undervalued. Thus, RSI is one of the most important crypto trading indicators to consider before investing in or trading a crypto token.

Support and resistance levels: Support and resistance levels of crypto tokens point to price levels where the token is usually supported or resisted from further movements. A support level can act as a price point where the token persistently stops falling and starts rising. At the same time, a resistance level can represent a prince point where the token repeatedly stops rising and starts to fall.

Stochastic Oscillator: This indicator compares an asset’s historical moving averages and closing price, acting as a momentum indicator for overbought or oversold conditions.

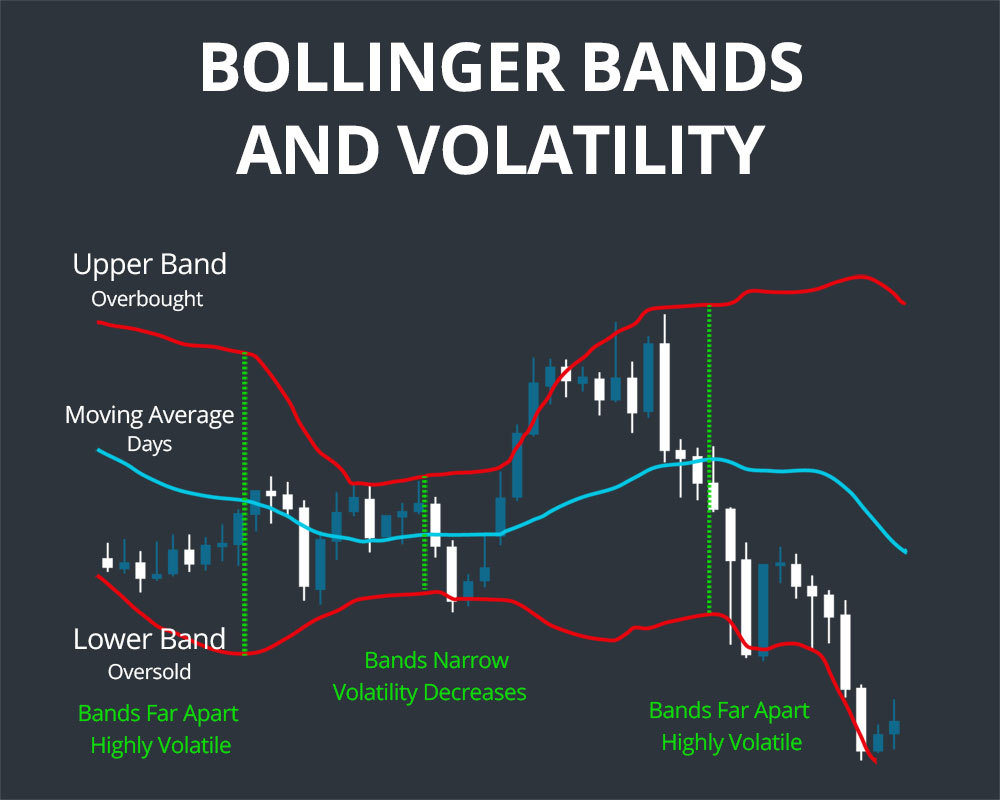

Bollinger Bands: Bollinger Bands are also momentum indicators, signifying an asset’s volatility according to the deviation between the bands. The upper and lower bands signify resistance and support levels respectively, while the middle band is a simple moving average of the asset in question over a certain period of time (i.e. 20 days).

Fibonacci Retracement: One can utilize this indicator to calculate a crypto token’s high and low points using the Fibonacci sequence, as its name suggests. The Fibonacci Retracement indicator depicts a crypto asset’s retracement from its earlier highs and also determines its support and resistance levels.

Fear and Greed Index: The Fear and Greed Index, also used in other public markets, is particularly leveraged for Bitcoin in the crypto market. The index suggests an upcoming correction or buying opportunity in the crypto market, analyzing the current conditions.

Effective usage of indicators in a volatile market for maximized returns

Pro-crypto traders use a combination of the above indicators for crypto for maximized profits from the market. With the cryptocurrency market holding potential for exponential returns, a carefully crafted trading approach with these crypto indicators will ensure big returns for you!

We hope this article will be beneficial for you in creating effective crypto trading strategies and achieving financial freedom.

Meanwhile, Millionero, a fast-growing crypto exchange, could become the ideal launchpad for your crypto trading journey. Leverage our user-friendly features and join the family today!