Disclaimer: Cryptocurrencies are an inherently volatile asset class, and investments can carry substantial risks. This information is for educational purposes only and should not be construed as financial advice. Always do your own research and conduct due diligence before investing in crypto projects.

Are you considering investing in crypto projects? Do you need help analyzing and investing in crypto projects before making investment decisions? You’re at the right place!

With an expected compound annual growth rate (CAGR) of 12.5% from 2023 to 2030, the global cryptocurrency market certainly looks very enticing. When investing in new crypto projects, you’re not only investing in a coin/token, but also in the underlying use case. This is where the dilemma of identifying promising projects comes from. This is exactly why we have curated a list of things to know before investing in crypto projects for you. Check it out!

What are cryptocurrency projects?

A cryptocurrency project is a blockchain-based initiative where cryptography is leveraged to create crypto coins/tokens. These work as utility tokens, internal currencies, and more. All new crypto projects aim to solve specific problems within certain industries, such as:

- Ripple (behind the crypto XRP) looking to simplify cross border transactions and

- Ethereum (behind ETH) having a goal to create a decentralized ecosystem to solve issues with traditional finance and more.

In fact, the first ever crypto project Bitcoin (behind BTC) itself introduced peer-to-peer, decentralized transactions to give power over their money back to users, in the wake of the financial crisis of 2008.

Investors and developers engage in new crypto projects to participate in the evolving landscape of digital finance and decentralized technologies, contributing to the growth and transformation of the blockchain ecosystem.

There are many up and coming, new crypto projects worldwide, along with the existing legacy cryptocurrency projects like Bitcoin and Ethereum. With so many projects available, it can be difficult to evaluate them and make a decision. This is where our checklist of important factors to judge new cryptocurrency projects comes into play.

Things to know before investing in crypto projects

Here is the list of things to know before investing in crypto projects.

Utility

The first factor to consider before investing in crypto projects is the project’s utility. Though some meme coins have been successful, projects with low utility are often at a higher risk of failing. The utility of new crypto projects is always detailed in their whitepaper for the investors to check out- such as the Bitcoin whitepaper. It is wise to avoid projects that do not have viable utility except for exceptional cases like those of meme coins.

Project stage

When investing in crypto projects, it is crucial to consider its stage as it can significantly impact the risk and potential return. Investing in different stages can mean different things for the investors.

- Pre-ICO: Investing in a project before the Initial Coin Offering (ICO) can yield high returns but is riskier as the project is still in its early stages.

- ICO: Investing in a project during its ICO can be a high-risk, speculative endeavor, but you get a potentially low entry price.

- Post-ICO: Investing in crypto projects post-ICO means investing in a platform with a proven product utility, market demand, and a solid track record. However, the prices may be higher with lower potential for gains.

- Established project: Investing in established crypto projects offers consistent returns but less room for exponential growth.

Transparency

Transparency in a crypto project means public team identities, clear roadmaps, well-defined whitepapers, clear communication, and explanation of decisions. While investing in crypto projects, choose transparent projects and be wary of those with hidden information or suspicious activity.

Team behind the project

The credibility of the team behind a project matters a lot. The promised features of a project only matter if the team can deliver them. So, knowing about the team behind the project is essential to determine if they can live up to their promises. Learn about the team’s experience, expertise, track records, and recent contributions to the blockchain community. If the team is credible, you are more likely to have confidence when investing in cryptocurrencies and relevant projects.

Backers

When investing in a cryptocurrency project, always investigate its backers and their reputation in the crypto industry as well. Opt for projects supported by reputable investors, established companies, or individuals with a proven track record in the crypto space. Be cautious of projects backed by unknown entities or those with a controversial past.

Community

Before investing in crypto projects, check the community behind them. A community’s size, engagement, and overall sentiment can offer valuable insights into the project’s real-world interest and adoption. You can look at social media platforms like X to analyze how well a project interacts with its community. Some projects also host their communities on platforms like Telegram, Discord, or Reddit. You can interact with them there to understand what individuals think of the project and make your decisions accordingly.

Tokenomics

Token economics, or Tokenomics, is the study of the supply, demand, distribution, and valuation of cryptocurrencies. By providing a framework for assessing a project’s economic structure, tokenomics enables investors to weigh the potential risks and rewards before investing in new crypto projects. It helps investors analyze the project’s profitability and make informed decisions.

A 60-40 distribution model is a good thing for a crypto token/coin to have, for example, which refers to the allocation of tokens between the public and the project team/developers. So 60% of the total tokens are available to the public, usually distributed through methods such as public sales, initial coin offerings (ICOs), airdrops, or other community-driven mechanisms. More public control can lead to a decentralized and community-driven governance structure. It implies that a significant portion of the decision-making power rests with the token holders, as they collectively own the majority of the tokens.

Meanwhile the remaining 40% is allocated to the project team, developers, advisors, usually for the internal development and sustainability of the project. This lowers the level of centralization in a project and makes it a safer investment.

DAO governance

A Decentralized Autonomous Organization (DAO) is a form of governance that operates without a central authority. In a DAO, decision-making power is distributed among all its participants, promoting transparency and empowerment. Investors must ensure that the DAO governance structure is transparent and accountable when choosing new crypto projects. They must also evaluate the project’s voting rights distribution, proposal mechanisms, and dispute resolution processes.

Lock and unlock period of tokens

A token lockup period is a predetermined period when the transferability of a specific token amount typically held by the project team, advisors, or investors is restricted. An unlock period is when the lockup restrictions end, allowing token holders to trade or sell their tokens freely.

Long lockups can be a positive sign as they prevent excessive token selling in the early stages, potentially stabilizing the price. Meanwhile frequent unlocks raise concerns about price stability and potential sell-offs. Thus, it is important to consider how lockup and unlock periods of the cryptocurrency project affect your investment goals and risk tolerance before investing.

The Sandbox (SAND) is a good project from this perspective. Token unlocks take place every six months or so, with the last one having taken place on August 14, 2023 and the next one scheduled for February 14, 2024.

Market demand and hype

While investing in crypto projects, assess the genuine need and demand for the project’s product or service beyond its publicity. Be wary of projects solely propelled by hype or fear of missing out (FOMO), as their long-term viability may be questionable.

Even if you invest in hyped projects, conduct comprehensive research to ensure their authentic value and long-term growth potential.

Influencer pump

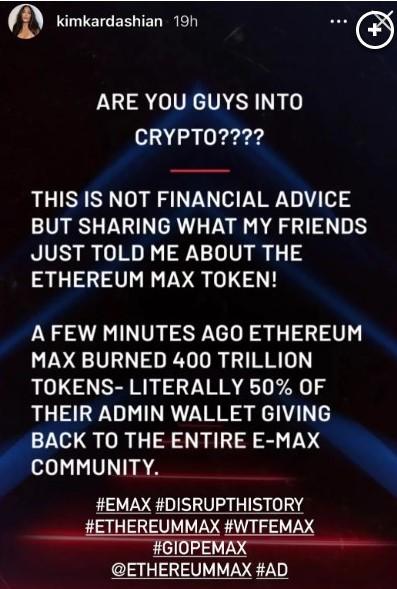

When considering investing in crypto projects, investors must be cautious of the ones promoted by influencers. Such projects may have undisclosed financial ties to the influencer, which can be misleading. For instance, in 2021, influencers Kim Kardashian, Floyd Mayweather, and Paul Pierce promoted an altcoin called EMAX, which caused its price to skyrocket 16 times within three days. However, the subsequent crash was just as swift. The incident prompted that it is always better to rely on independent research and analysis before investing in cryptocurrencies and their backing projects.

Market cap

When evaluating a crypto project, consider its market capitalization compared to its development stage. Be cautious of early-stage projects with excessively high market caps, as it may indicate that the project is overvalued. Instead, it is better to analyze new crypto projects’ potential for growth and market adoption to determine its true worth. This analysis will provide valuable insights on whether to invest in the project.

Other Quantitative Data

When you invest in new crypto projects, you must have a handle on how the crypto market works in general and what terms are relevant in understanding a project’s performance and future opportunities. Aside from market cap, look at components like traded volume, total supply, circulating supply, maximum supply, active users, and transaction rates.

Partnerships and collabs

You may also want to look into the project’s partnerships and their legitimacy before investing in crypto projects. Partnerships with popular and established crypto projects are a promising indicator of its capabilities. Remember to check the benefits of these partnerships for yourself to ease decision-making.

Major events

Before investing in crypto projects, be aware of major events like network upgrades, regulatory changes, partnerships, listings, team changes, security breaches, market sentiment shifts, technological advancements, competition, and global economic events. These events can significantly impact a project’s functionality, value, and future success. So stay informed about major events through the project’s website and social media presence, and align your investment decisions accordingly.

Exit strategy

Lastly, it is crucial to have an exit strategy before investing in crypto projects. An exit strategy helps in aligning investment goals with the project’s potential. Identifying your desired exit helps you choose projects that fit your goals and risk tolerance, whether you seek quick short-term gains or long-term returns through project success.

Having an exit strategy also helps to avoid common pitfalls, such as holding onto a failing project out of hope or panic-selling during a temporary dip. However, remember to keep your exit strategy flexible. Be prepared to adjust your plan depending on market conditions and the project’s performance. While the future is always uncertain, having a planned roadmap helps you navigate your investing journey more confidently.

Invest with confidence and DYOR!

If you are new to crypto, we can not stress the importance of DYOR or Do Your Own Research enough. Read up on new crypto projects, study their risks and compare their benefits, look into competitors doing similar things, and then decide which crypto to invest in. While you keep in mind the checklist we have shared above, remember to keep adding new factors to it based on your research and investment goals for stress-free investing in cryptocurrencies!

Check out the Millionero blog for more insightful updates on cryptocurrency! Further, for crypto trading, Millionero can be your perfect partner. Join our family today, and start earning while you learn the ropes of crypto trading!