OM Token Crash: 5.5 Billion USDT Gone in an Hour

Over the weekend, the OM token from MANTRA nuked — hard. On Saturday, it plummeted 90% in a matter of hours, dropping from 6.3 to 0.37 USDT, briefly recovering to below 1 USDT by Monday. That’s a 5.5 billion wipeout, almost like a mini LUNA moment.

Source | Tradingview

So, what triggered it?

Nobody knows but forced liquidations is the best theory for now. Some major CEXs apparently yanked the plug on overleveraged OM traders without warning during low-liquidity Sunday hours (Asia morning). There weren’t enough buyers to absorb the sell pressure, and the whole thing collapsed like a house of leverage cards.

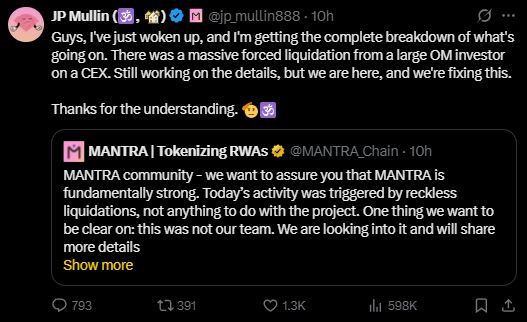

John Patrick Mullin (MANTRA’s co-founder) posted on X blaming CEXs for “reckless forced closures,” saying the team didn’t sell, and all tokens remain locked. The community’s reaction? Mixed. Some users are loyal. Others are furious, demanding accountability, even buybacks.

Source | X @jp_mullin888

Bottom line:

The crash shows how dangerous leverage is — especially during sleepy hours. Transparency and liquidity still rule crypto. MANTRA has regulatory backing from Dubai’s VARA, but trust takes a hit like this personally.

US-China Tariffs Escalate (Again)

Meanwhile, in geopolitics land — the US-China trade war just escalated.

- The US slapped a 145% total tariff on Chinese imports.

- China fired back: 125% tariff on US goods + stopped rare earth mineral exports (essential for EVs, chips, aerospace).

- Even UK businesses are reacting — some suspending imports to avoid getting wrecked.

This isn’t just economic drama — this is real pressure. China halting rare earths could wreck global supply chains.

The back-and-forth tit-for-tat is also triggering market volatility, and investors are stressed out. Which brings us to…

10-Year Treasury Yield Is Now 4.47% — And That’s a Problem

That number might sound boring, but it’s not.

The 10-year Treasury yield hit 4.47%, a big spike from under 4% just last week. That’s super unhealthy for the US government’s finances. Here’s why:

- Higher yield = more interest Uncle Sam pays on its debt.

- Interest payments are expected to hit $952B in 2025. That’s more than Medicare.

- If this keeps up, debt payments alone could eat up 18% of all government revenue by year-end.

Source | Tradingview

Markets are watching this closely. It signals inflation fears, weak fiscal control, and makes borrowing way more expensive. In short: high yields choke the budget.

This Week’s US Economic Events

Here’s what to watch this week — all in UTC:

Monday (Today)

- 10:00 pm – Philly Fed President Harker speaks

- 11:40 pm – Atlanta Fed’s Bostic talks

Tuesday (April 15)

- 12:30 pm – March Import Prices (expected: +0.1%)

- 12:30 pm – Empire State Manufacturing Index (forecast: -10)

Wednesday (April 16)

- 12:30 pm – Retail Sales (expected: big jump +1.2%)

- 1:15 pm – Industrial Production & Capacity Use

- 2:00 pm – Business Inventories, Home Builder Confidence

Thursday (April 17)

- 12:30 pm – Jobless Claims, Housing Starts, Building Permits

- 12:30 pm – Philly Fed Survey (expected drop)

Friday (April 18)

- 12:00 pm – San Francisco Fed’s Mary Daly speaks

This is a data-heavy week. Retail sales will show if the consumer is still holding strong.

Bad numbers = bad mood for the market.

Big Token Unlocks Incoming

StarkNet (STRK)

Date: April 15, 2025

Unlock Value: 16.03M USDT (4.38% of marketcap)

% of Total Supply: 1.28%

Number of Tokens: 127.60M STRK

Arbitrum (ARB)

Date: April 16, 2025

Unlock Value: 27.89M USDT (2.00% of marketcap)

% of Total Supply: 0.93%

Number of Tokens: 92.63M ARB

Parcl (PRCL)

Date: April 16, 2025

Unlock Value: 9.57M USDT (57.6% of marketcap)

% of Total Supply: 16.2%

Number of Tokens: 161.70M PRCL

ApeCoin (APE)

Date: April 17, 2025

Unlock Value: 6.55M USDT (1.92% of marketcap)

% of Total Supply: 1.54%

Number of Tokens: 15.38M APE

Omni Network (OMNI)

Date: April 17, 2025

Unlock Value: 29.15M USDT (83.5% of marketcap)

% of Total Supply: 16.0%

Number of Tokens: 15.98M OMNI

deBridge (DBR)

Date: April 17, 2025

Unlock Value: 25.41M USDT (61.7% of marketcap)

% of Total Supply: 11.1%

Number of Tokens: 1.11B DBR

Immutable (IMX)

Date: April 18, 2025

Unlock Value: 10.22M USDT (1.37% of marketcap)

% of Total Supply: 1.23%

Number of Tokens: 24.52M IMX

UXLINK (UXLINK)

Date: April 18, 2025

Unlock Value: 16.24M USDT (9.86% of marketcap)

% of Total Supply: 3.33%

Number of Tokens: 33.33M UXLINK

OFFICIAL TRUMP (TRUMP)

Date: April 18, 2025

Unlock Value: 333.53M USDT (19.9% of marketcap)

% of Total Supply: 4.00%

Number of Tokens: 40.00M TRUMP

Saros (SAROS)

Date: April 19, 2025

Unlock Value: 25.04M USDT (8.15% of marketcap)

% of Total Supply: 2.14%

Number of Tokens: 213.93M SAROS

Polyhedra Network (ZKJ)

Date: April 19, 2025

Unlock Value: 34.90M USDT (25.7% of marketcap)

% of Total Supply: 1.55%

Number of Tokens: 15.50M ZKJ

TL;DR – What to Watch This Week

- OM crash revealed just how fragile leveraged altcoins are, especially during quiet hours.

- Tariffs + rare earth bans = global trade pain incoming.

- 10-year yield at 4.47% is a massive red flag for debt sustainability.

- Retail sales + jobless claims will be key for Fed expectations.

- Token unlocks could shake smaller-cap tokens midweek.

We’ll be back with the midweek update if anything big happens. That said, none of this is financial advice. You should always DYOR — do your own research. If you want to dig deeper, check out the articles on blog.millionero.com..

And when you’re ready to trade?

Come trade spot and perpetual futures on Millionero. Europe’s fastest-growing, low-fee crypto exchange.

Stay smart. Stay sharp. Let’s see how the week unfolds.