This week, there are several important economic updates and crypto market updates to watch. These include consumer price indices, jobless claims, and speeches from key Federal Reserve officials. Additionally, developments in the cryptocurrency market could cause notable price movements.

Wednesday, November 13: Economic Data Releases (US)

13:30 UTC – Consumer Price Index (CPI) for October

The Consumer Price Index (CPI) measures how prices for goods and services change over time. This data is important for understanding inflation in the U.S. economy. On Wednesday, the U.S. will release the CPI for October.

- CPI (Month-over-Month): Expected to rise by 0.2% (same as last month).

- CPI (Year-over-Year): Expected to increase by 2.5%, slightly higher than the 2.4% from the previous month.

This report gives insights into inflation and helps the Federal Reserve decide on interest rate policies.

13:30 UTC – Core CPI for October

Core CPI excludes food and energy prices, which are more volatile. This number gives a clearer picture of long-term inflation trends.

- Core CPI (Month-over-Month): Expected to increase by 0.3% (same as last month).

- Core CPI (Year-over-Year): Expected to show a 3.3% increase, unchanged from the previous month.

Thursday, November 14: Key Economic Events (US)

12:00 UTC – Federal Reserve Governor Adriana Kugler Speaks

Federal Reserve Governor Adriana Kugler will give a speech about the economy and monetary policy. Investors will be watching for any signs of changes in interest rate strategies or new economic outlooks.

13:30 UTC – Initial Jobless Claims (Nov. 9)

This report shows how many people filed for unemployment benefits for the first time. High numbers can signal trouble in the job market.

- Expected Claims: 225,000, slightly higher than last week’s 221,000.

13:30 UTC – Producer Price Index (PPI) for October

The Producer Price Index measures inflation at the wholesale level, offering insights into potential future consumer price changes.

- PPI (Month-over-Month): Expected to rise by 0.2%, compared to 0% last month.

- PPI (Year-over-Year): Expected to show a 1.8% increase.

13:30 UTC – Core PPI for October

Core PPI excludes food and energy prices, giving a clearer view of inflation at the wholesale level.

- Core PPI (Month-over-Month): Expected to rise by 0.1%.

- Core PPI (Year-over-Year): Expected to be 3.2%.

15:00 UTC – Federal Reserve Chair Jerome Powell Speaks

Source | NBC News

Federal Reserve Chair Jerome Powell will give a speech that could include updates on the economy and future monetary policy. His comments are expected to influence market sentiment.

Cryptocurrency Market Updates

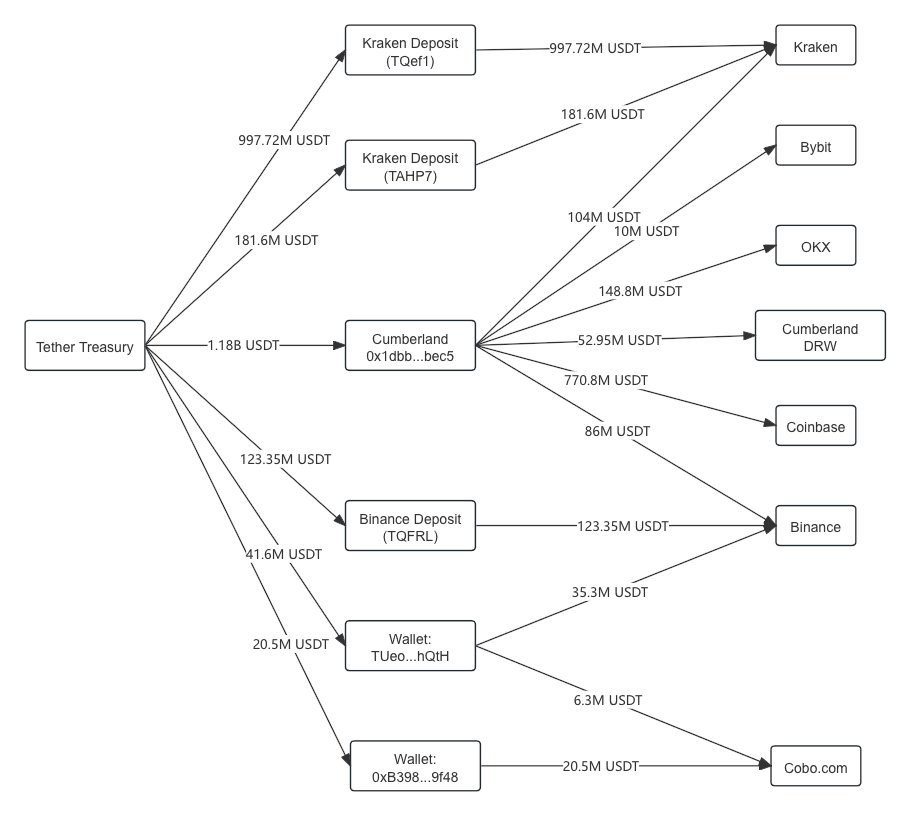

Tether Prints $2 Billion in 2 Days

Tether has recently printed $2 billion worth of USDT in just two days. This action has raised questions about the potential impact on the cryptocurrency market, as it often leads to an influx of funds, possibly boosting the value of major cryptocurrencies like Bitcoin and Ethereum.

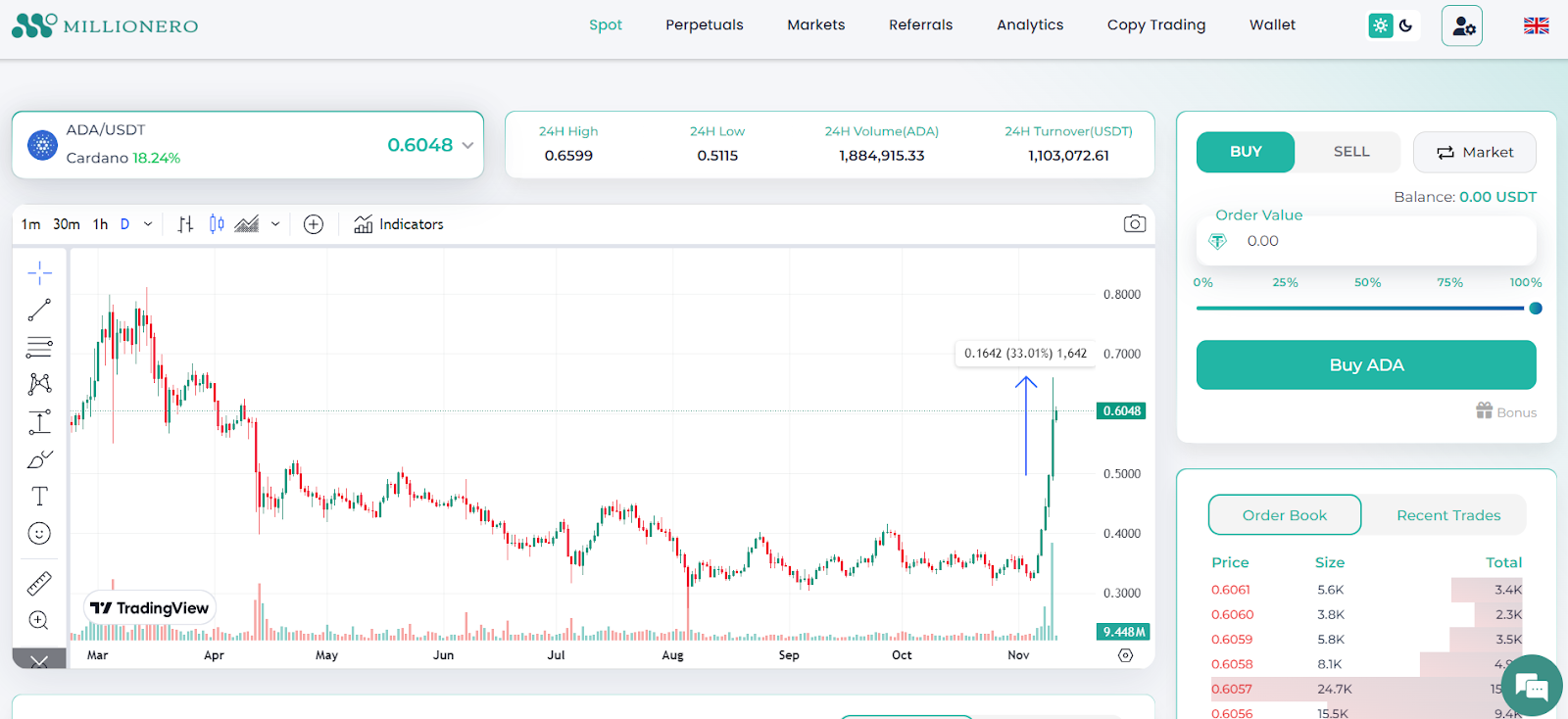

Cardano’s Role in U.S. Crypto Regulations

Charles Hoskinson, the founder of Cardano $ADA, has confirmed that he will serve as an advisor to the U.S. government under the Trump administration. His goal is to help create clearer cryptocurrency regulations. This announcement has caused a 31% surge in Cardano’s price.

Source | Millionero

Standard Chartered Predicts a $10 Trillion Crypto Market

Analysts at Standard Chartered are predicting that the cryptocurrency market could reach $10 trillion by 2026. They believe that favorable regulatory changes and growing institutional interest will drive the market forward. The report also forecasts that Bitcoin could hit $125,000 under the Trump Presidency.

Source | Yahoo FInance

Bitcoin Price Prediction for End of 2024

Ki Young Ju, CEO of CryptoQuant, has predicted that Bitcoin could see a 24% drop in price by the end of 2024. He suggests that Bitcoin may end the year at around $58,974, despite hitting a new all-time high of $81,486 recently.

Source | X @ki_young_ju

Upcoming Token Unlocks and Market Impact

Several major cryptocurrency projects are unlocking tokens in the coming days, which could affect market prices. These unlocks release a certain percentage of a coin’s total supply, increasing the circulating supply and often causing volatility.

- NEAR Protocol (Nov. 11): 12.86 million tokens will be unlocked, which is a small portion of the total supply and unlikely to cause major price changes.

- Cardano (Nov. 11): 18.53 million tokens will be unlocked, representing a small fraction of the total supply, so it may have limited market impact.

- Ethena (Nov. 13): 12.86 million tokens will be unlocked, a moderate amount that could see some market interest.

- Starknet (Nov. 15): Starknet will unlock 64 million tokens, representing 3.05% of its circulating supply. This larger release may create significant price volatility due to potential selling pressure.

- Arbitrum (Nov. 16): 92.65 million tokens will be unlocked, which could have a notable impact on the price due to the large amount being released.

Conclusion

This week brings important updates on U.S. economic data and key speeches from Federal Reserve officials, alongside significant movements in the cryptocurrency market. With inflation data, jobless claims, and price indices all coming into focus, there’s plenty of information to digest. Meanwhile, in the crypto space, events like Tether’s recent actions and upcoming token unlocks could lead to notable price fluctuations.

To stay ahead in the market, make sure to do your own research (DYOR). For in-depth analysis and the latest trends, visit blog.millionero.com. After doing your research, you can trade both spot and perpetual futures on Millionero, a platform designed for traders looking to take advantage of market opportunities.

Stay informed, trade smart, and best of luck this week!