Weekly Market Recap: This past week delivered impactful events in cryptocurrency and broader financial markets, highlighting significant political interactions, economic indicators, and shifting market dynamics.

Market Optimism Soars

The S&P 500 experienced its most substantial gain on Friday, adding over $1 trillion in market cap. This remarkable rise demonstrates investors’ growing optimism despite global challenges. However, this gain happened on Friday after falling 10% over four weeks due to Trump’s tariff announcements. Even though Friday was green, the index still closed the week in red.

Source | heatmap

Diplomatic Developments and Market Stability

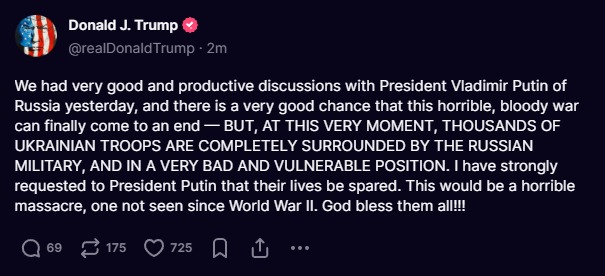

US President Trump reported “very good and productive” discussions with Russian President Vladimir Putin, hinting at a potential end to ongoing conflicts. Trump’s appeal to spare Ukrainian lives contributed positively to global market sentiment by potentially easing geopolitical tensions.

Source | TruthSocial @realDonaldTrump

Gold Prices Hit Historic High

Gold prices crossed the unprecedented milestone of $3,000 per ounce, reflecting increased investor interest in secure assets amid persistent global uncertainties.

Source | Investing

Ethereum Prepares for Major Upgrade

Ethereum developers announced their third testnet, named “Hoodi,” in preparation for the significant Pectra upgrade. This update highlights Ethereum’s ongoing improvements and the potential implications for the asset’s future performance.

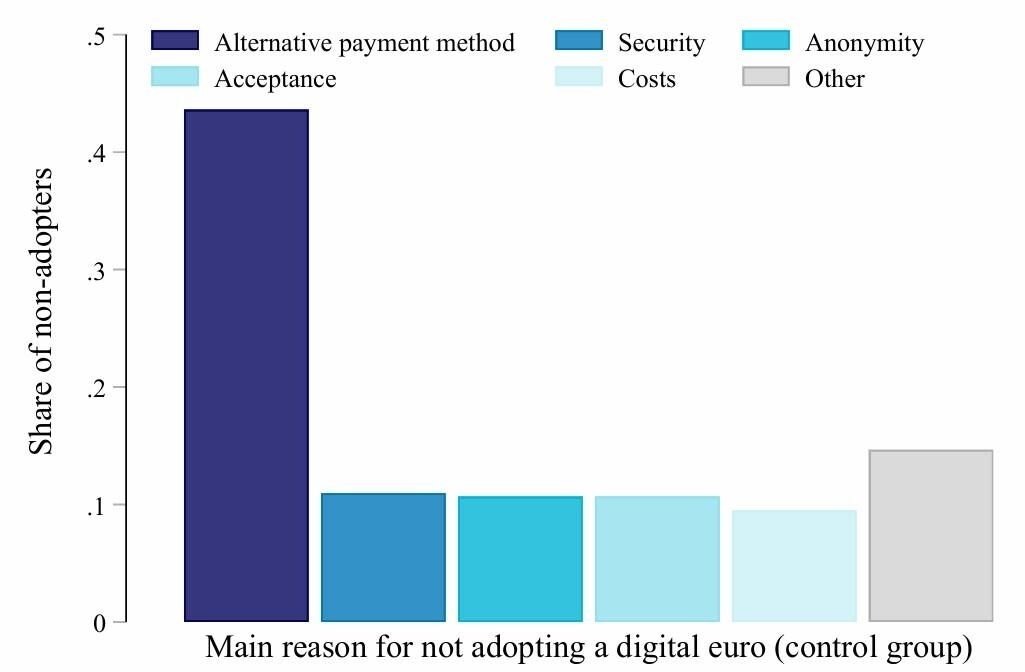

Digital Euro CBDC Faces Challenges

A survey conducted by the European Central Bank revealed limited public enthusiasm in the EU for adopting the digital euro, raising concerns over the project’s future and acceptance.

U.S. Government Shows Increased Interest in Bitcoin

Reports emerged indicating the U.S. government’s active pursuit of substantial Bitcoin purchases, reinforcing strategic commitments made during the recent White House Crypto Summit.

Source | Decrypt

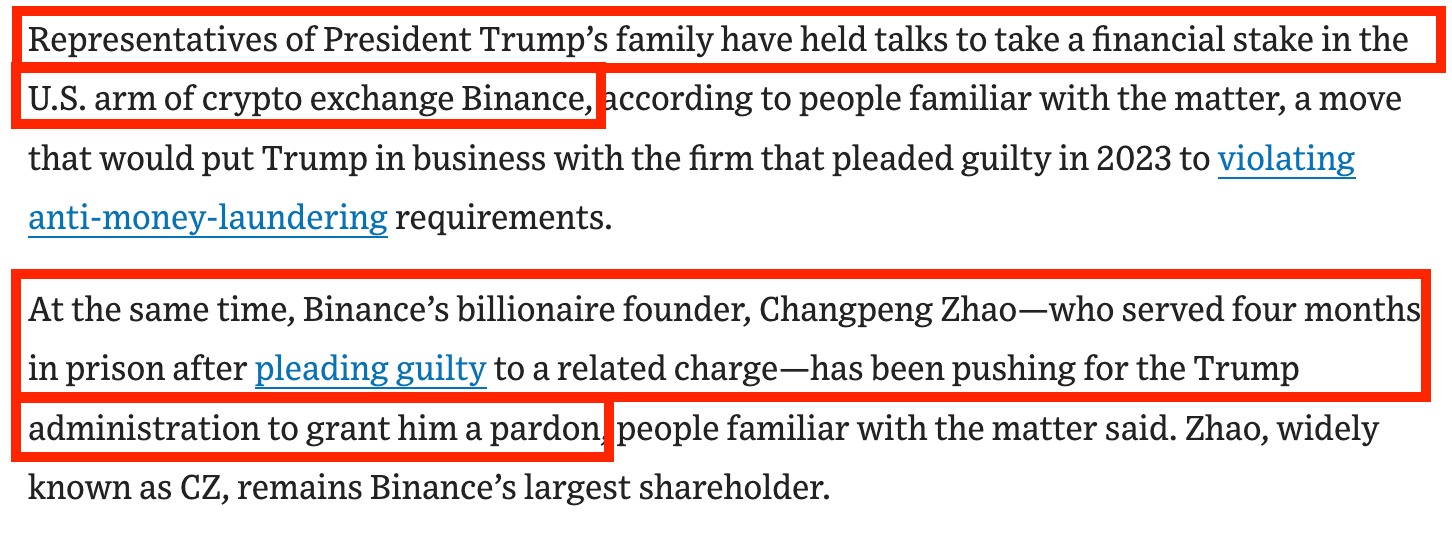

Politics Meets Crypto: Trump Family and Binance

The Trump family reportedly explored acquiring a stake in Binance, the world’s largest cryptocurrency exchange. Simultaneously, Binance’s founder, Changpeng Zhao, was reportedly seeking a pardon from Trump, underlining significant interactions between political power and the cryptocurrency industry.

Source | WSJ

Inflation Data Signals Economic Relief

Economic data revealed continued easing in inflation, with February’s CPI dropping to 2.8%, lower than market expectations. Similarly, PPI inflation also declined, boosting investor optimism and positively influencing crypto markets, notably Bitcoin.

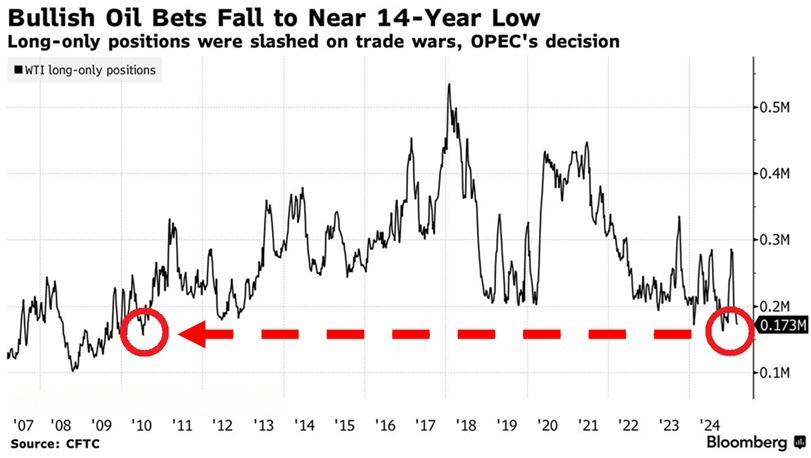

Oil Market Faces Declining Confidence

Hedge funds significantly reduced their long positions in WTI crude oil, reflecting cautious sentiment as oil prices reached near six-month lows, impacted by ongoing economic uncertainties.

Source | Bloomberg

SEC Advances Crypto Regulation

The U.S. Securities and Exchange Commission (SEC) officially acknowledged applications from Fidelity and Franklin for Ethereum staking funds, marking a significant step forward for institutional involvement in cryptocurrency.

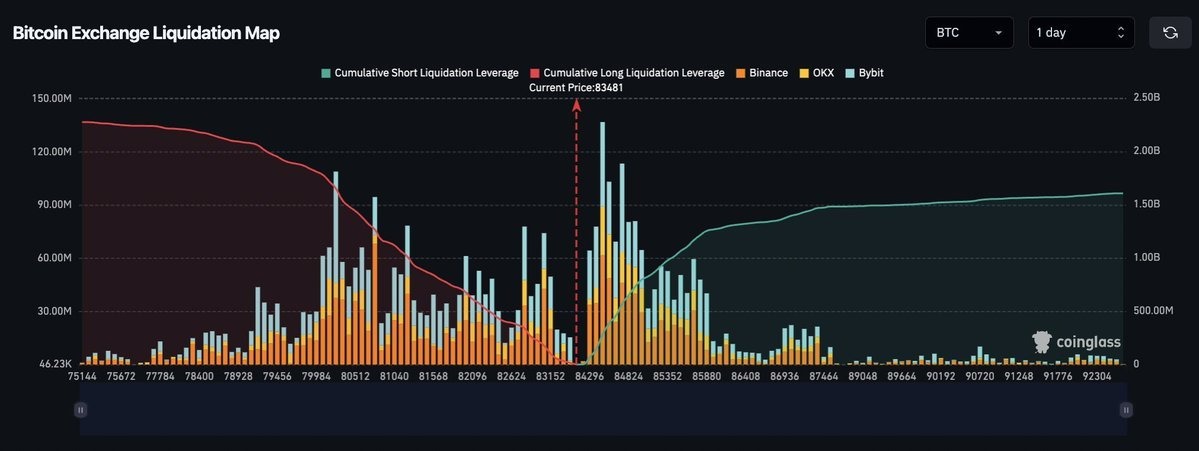

Bitcoin Shorts at Risk

Around 1.5 billion USDT in Bitcoin short positions faced potential liquidation risk should Bitcoin prices return to the crucial 90k level, indicating a potentially pivotal moment for traders.

Source | Coinglass

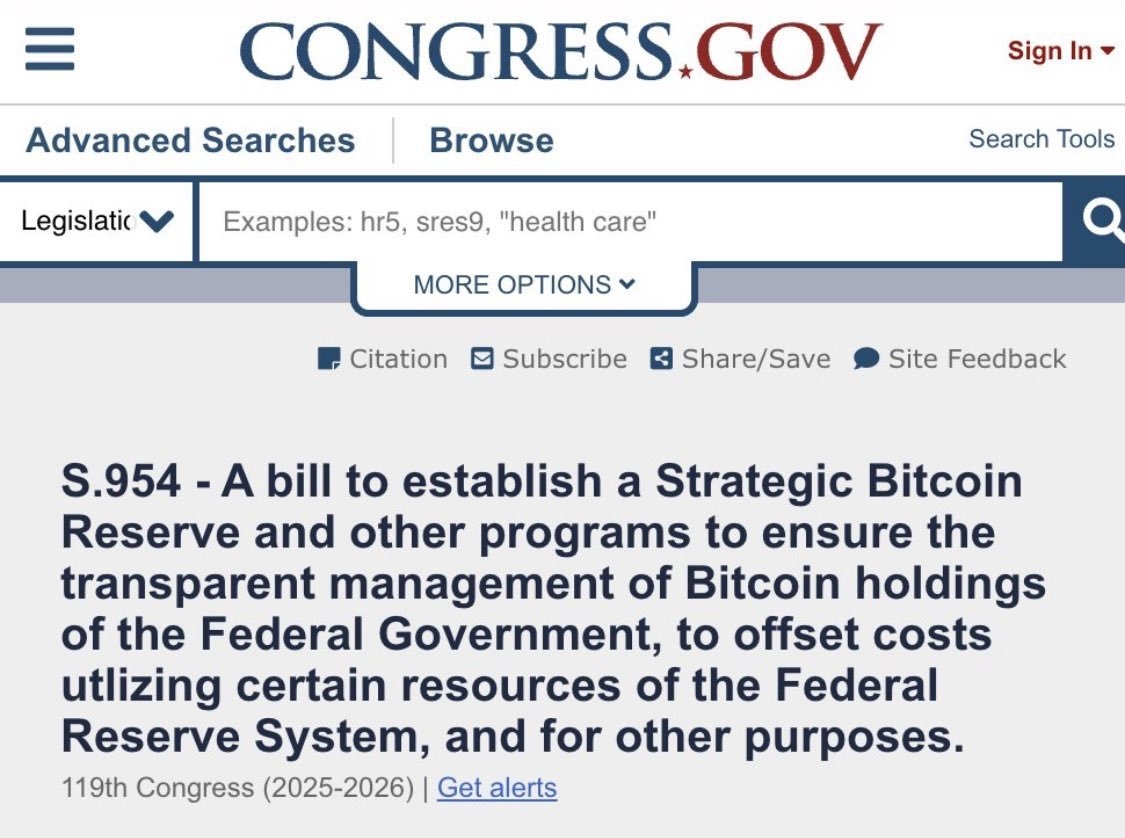

Legislative Support Strengthens

The Bitcoin Law was officially published on the U.S. Congress website, highlighting increasing legislative support for cryptocurrencies in the United States.

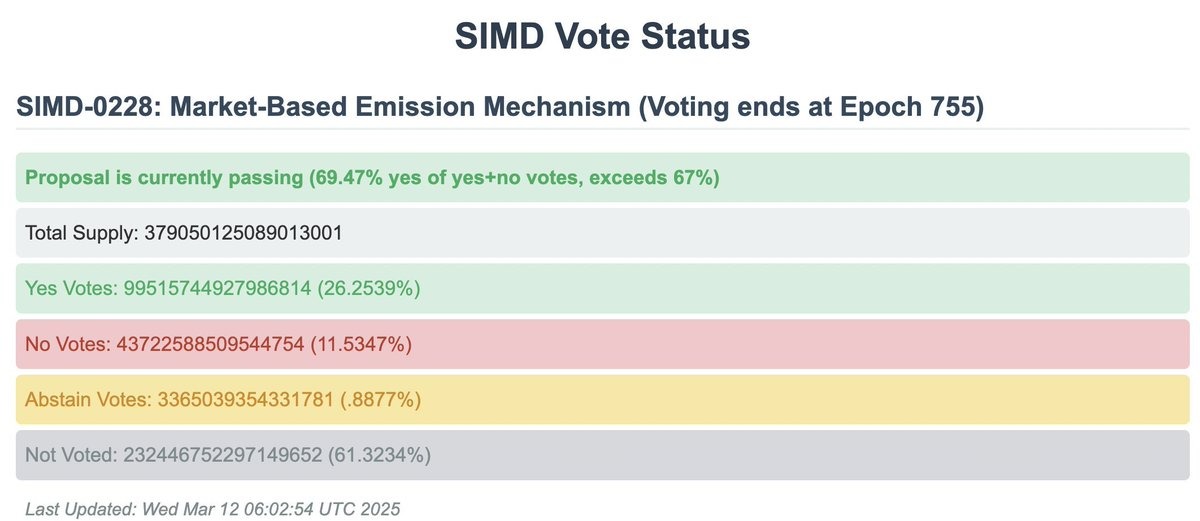

Solana Moves Towards Economic Stability

Solana’s community approved proposal SIMD-0228, aiming to reduce the inflation rate of SOL by 80%, indicating significant community-driven financial restructuring efforts.

SEC Delays ETF Decisions

The SEC postponed its decisions on several crypto ETFs, including products from VanEck and Grayscale involving Solana, XRP, Litecoin, and Dogecoin, indicating continued regulatory caution.

Expert Predicts Massive Bitcoin Growth

Bitwise‘s Chief Investment Officer, Matt Hougan, predicted Bitcoin’s valuation could reach between $10-$50 trillion, highlighting the establishment of the U.S. Strategic Bitcoin Reserve as a transformative catalyst.

VanEck Expands Crypto ETF Portfolio

VanEck registered an Avalanche-linked ETF, signaling an expanding range of crypto-based financial products entering mainstream investment channels.

Traditional Banking Embraces Crypto

Spain’s second-largest bank, BBVA, secured regulatory approval to offer Bitcoin and Ethereum trading services, further integrating cryptocurrency with traditional financial institutions.

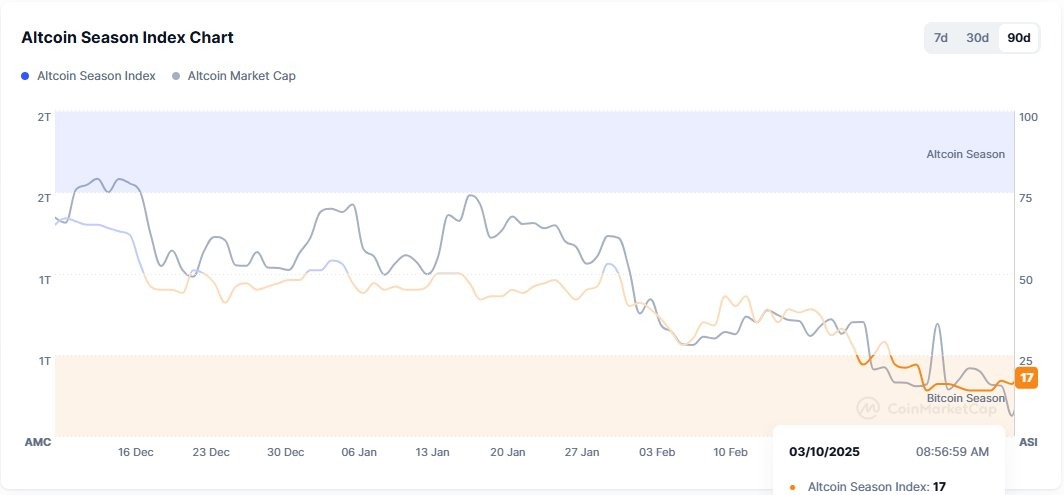

Altcoins Lose Appeal

The Altcoin Season Index reached its lowest point since 2024, reflecting caution and diminished investor enthusiasm toward smaller cryptocurrencies.

Source | Coinmarketcap

MicroStrategy Continues Bitcoin Bet

MicroStrategy announced plans to issue up to $21 billion in shares to fund additional Bitcoin purchases, reinforcing ongoing institutional support for cryptocurrency.

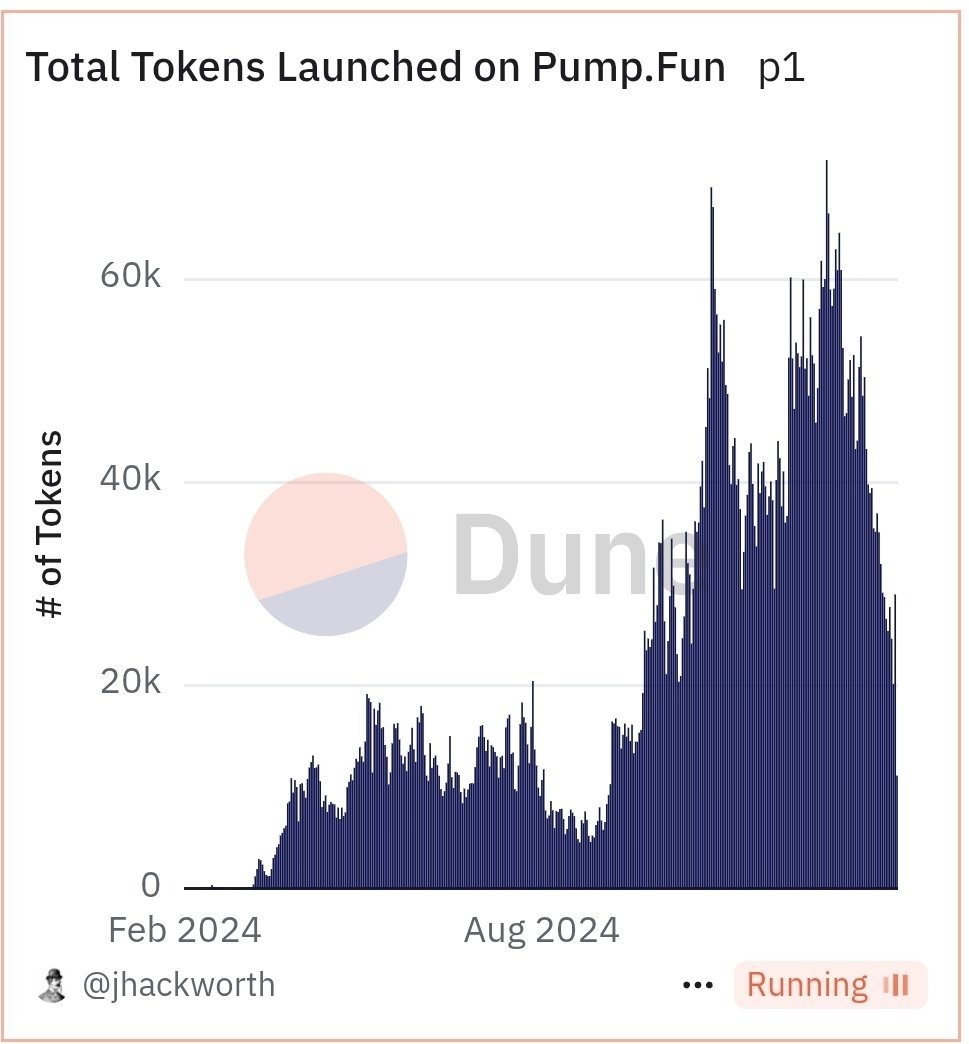

Meme Coin Mania Cools Down

There was a notable drop in the creation of meme coins on platforms like Pump Fun, suggesting that the cryptocurrency market might be shifting towards greater stability, away from speculative frenzy.

Source | Dune Charts

Final Thoughts

The past week underscored cryptocurrency’s dynamic nature, strongly influenced by regulatory shifts, macroeconomic data, and political developments. As markets respond positively to easing inflation and growing institutional adoption, investors remain cautiously optimistic about future trends.

Please note this article is for informational purposes only and should not be considered financial advice. Always conduct your own research before investing. You can explore further insights and stay informed through blog.millionero.com. If you feel prepared, come trade spot and perpetual markets on Millionero. When navigating these volatile markets, careful analysis is essential.