The cryptocurrency market (and financial markets in general) is filled with all sorts tools and techniques that help traders earn and maximize profits while constantly navigating through market trends and shifts. The market is driven by multiple factors, one of which is ‘market depth.’ This tool stands out as one of those that allows you to make informed trading choices.

In this blog, I will discuss more details on market depth, driving factors, and how it influences certain crypto trading strategies. We will also inform you about the risks involved. Let’s get started.

Crypto market depth: definition and importance

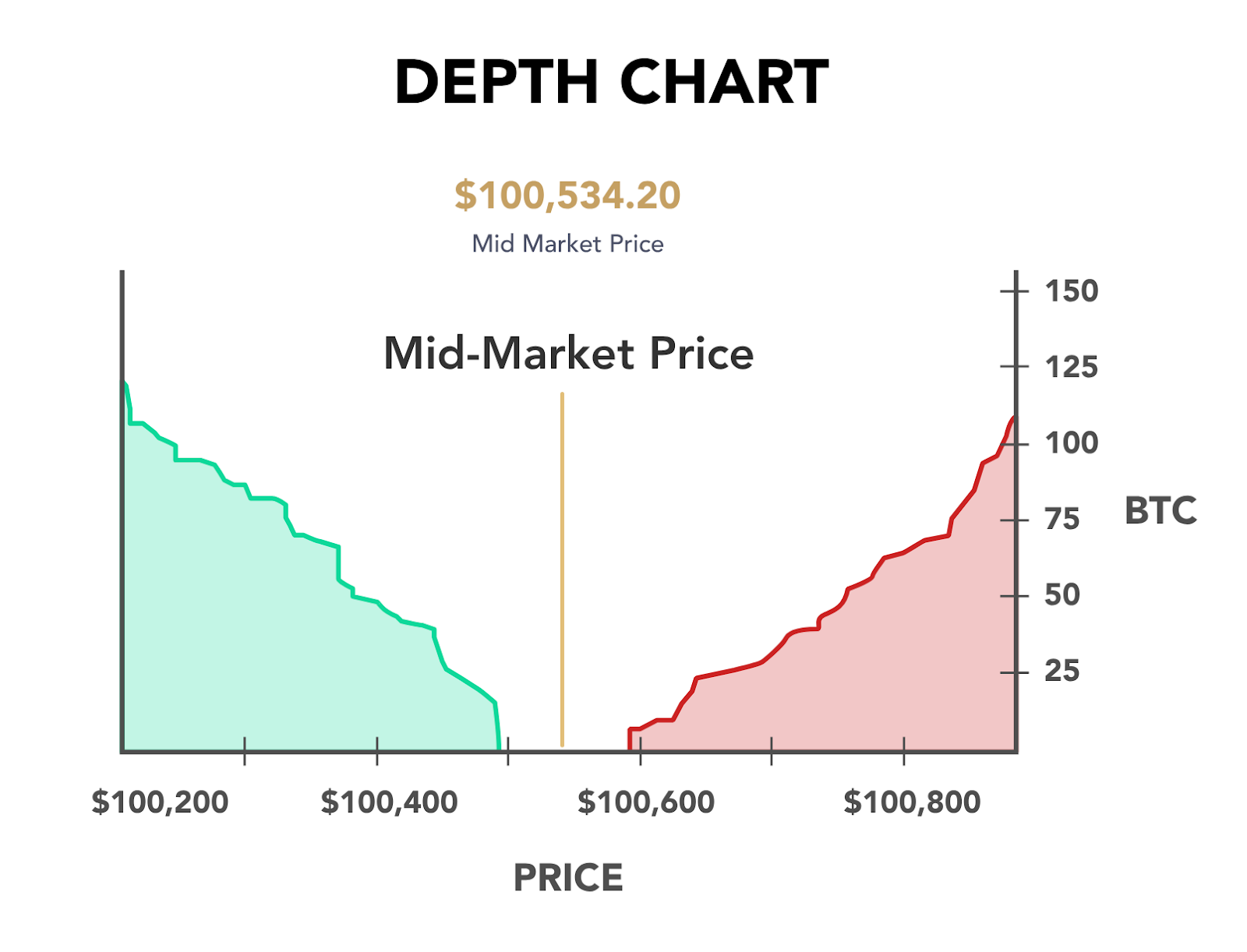

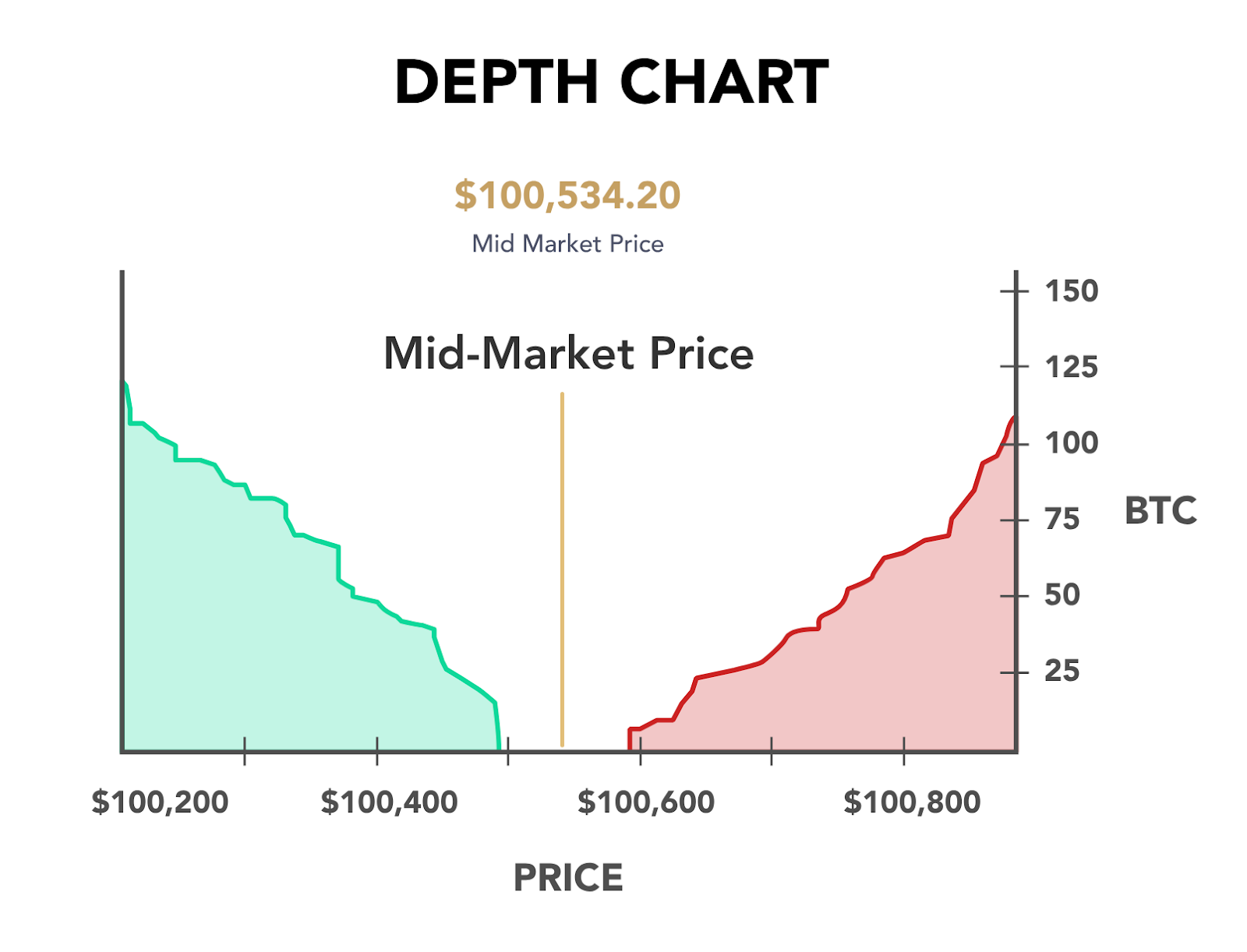

Crypto market depth, also known as depth of market (DOM) or order book liquidity, tells us about the total volume of buy and sell orders at different prices. It gives us an insight into how well the cryptocurrency market can handle large trades without causing major price shifts.

The real-time visuals on the chart provide valuable information about buy orders (bids) and sell orders (asks). Whether you are an experienced trader or a beginner, the chart analysis will help you take a good look at the market’s supply and demand dynamics, along with mid-market prices.

The primary elements of market depth are – Bids, Asks, and Bid-Ask spread.

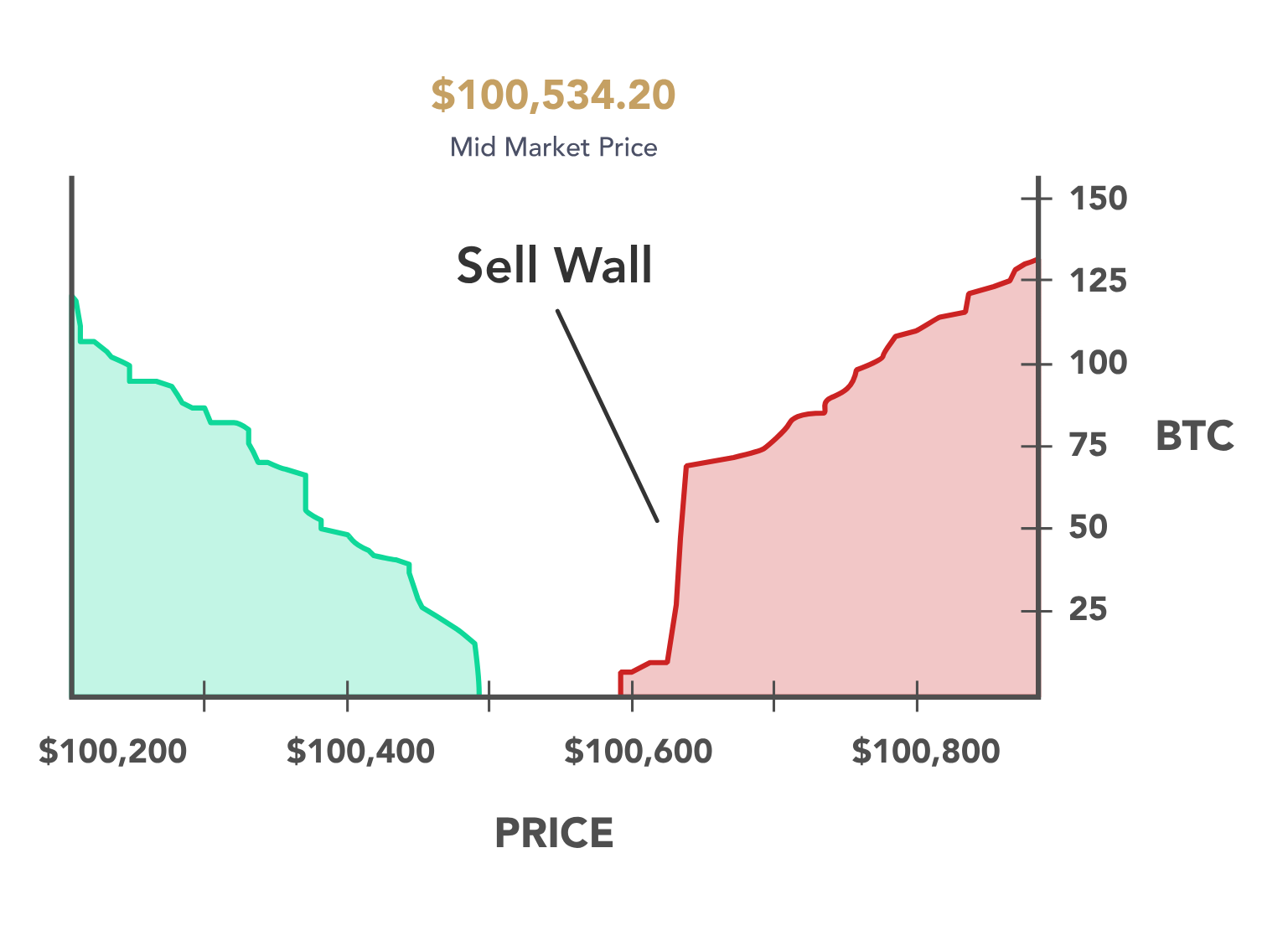

The bid and ask lines (shown in the charts below) represent the cumulative value of BTC’s purchase and sell orders at a specific price. Here, the DOM charts represent BTC’s supply and demand and potential price changes.

Why do you think the market depth is important? It provides traders with crucial knowledge about market liquidity, price stability and discovery, and also trade execution speeds.

- Liquidity: DOM offers significant insight into market liquidity, indicating how easily crypto assets can be purchased and sold without causing any significant price swings.

- Price stability and discovery: A market with substantial liquidity can handle large volumes of cryptocurrency trades without impacting prices. This stability attracts more investors to the ecosystem. Moreover, resistance and support levels, trends, and chart patterns indicate future price shifts. This helps traders and investors to strategize their trade entry and exit points effectively.

- Trade execution speed: DOM affects trade execution speed. Due to many buy and sell orders in the cryptocurrency market, trades can be executed quickly, to maximize the benefit of short-term price fluctuations.

Factors impacting crypto market depth

Now, let us take a look at some of the crucial factors that affect cryptocurrency market depth.

- Liquidity: When there are more people buying and selling crypto assets, there is more liquidity. On the contrary, when there are fewer traders, large orders can cause unpredictable price swings, making the market less steady.

- Bid-Ask spread: When there’s little difference between the highest bid and lowest ask, the spread implies large trading volumes and a stable market.

- Cryptocurrency exchange popularity and volume: Major cryptocurrency exchanges, like Millionero, with many active users and high trade volume, have better market presence and stability.

- Crypto pairs: Different cryptocurrency trading pairs may have different market presence. Major trading pairs like BTC/USDT and ETH/USDT have more stability and high trading volume than less prevalent ones.

- Economic indicators: Positive economic growth and news can deeply impact the market sentiment and boost traders’ confidence in the crypto market. On the flip side, when things are uncertain, the market can get challenging as people become more cautious.

- Laws and regulations: Adhering to stringent laws and regulations fosters a transparent and secure trading environment which boosts users’ confidence and involvement. This helps to make the market stronger and more active.

Market depth influencing crypto trading strategies

Let us now discuss some crypto trading strategies influenced by market depth.

Position trading

Position traders concentrate on long-term trends and hold assets for months or even years. Although immediate execution isn’t the most critical element here, deep markets can aid by enabling them to execute large trades without significantly influencing prices and allowing them to sell their holdings when needed.

Swing trading

Swing traders keep positions open for a few days to a week or weeks to profit from short-term market price fluctuations. In a swing trading strategy, traders can enter and exit trades easily, which lowers slippage and provides better execution prices and a smooth trading experience.

Scalping

Scalping is a quick crypto trading strategy based on minor price changes that allow traders to make multiple small profits daily. Market depth provides the liquidity needed for swift entry and exit plans without affecting cryptocurrency prices and ensures tighter bid-ask spreads.

Algorithmic trading

It uses advanced computer programs to execute trades based on pre-set criteria. These algorithms evaluate the market depth and optimize trade execution to ensure minimal costs and market impact. High-frequency trading algorithms can perform efficiently.

Arbitrage

In arbitrage trading, traders exploit price differences of the same asset at different exchanges. DOM simplifies trade execution and lowers slippage, making it easier to take advantage of these short-lived opportunities before prices shift.

Risks involved in crypto market depth

Though market depth influences various crypto trading strategies and is important to gain market insights, it has certain risks associated with it.

Market volatility

Cryptocurrency markets are quite volatile, with prices being affected by supply and demand dynamics. If volatility is managed properly, it can be a source of profit, but it is also better to use risk management strategies to prevent potential losses.

Slippage

It is the difference between the price at which an order is executed and the requested price. Slippage happens when the market moves against a trade and the original price is no longer available when it is processed. One way to tackle slippage is to have stop-loss orders.

Market manipulation and scams

Crypto markets can be susceptible to manipulations, such as spoofing, wash trading, and pump-and-dump schemes that artificially fluctuate prices. This leads to many scams and security breaches in the network.

Lack of transparency

Market depth data can be misinterpreted and may not represent the true market conditions especially when there is low liquidity. A trader must rely on trustworthy sources and regulated exchange platforms to avoid being misled.

The bottomline on crypto market depth

Market depth or depth of market (DOM) refers to the total volume of buy (bid) and sell (ask) orders at different prices. Liquidity, laws and regulations, economic indicators, major cryptocurrency platforms, and trading pairs are the main factors affecting DOM. It also influences crypto trading strategies like swing trading, scalping, arbitrage, etc. Though there are several benefits, DOM is associated with risks and challenges of market volatility, slippage, manipulation, and lack of transparency.

If you are new to the crypt trading market, Millionero is the perfect place to start your trading journey! Our exchange platform is designed to suit all newcomers as well as experienced traders. For more updates, join Millionero, explore our blogs, and follow the latest global crypto news!

Disclaimer: Cryptocurrencies are an inherently volatile asset class, and investments can carry substantial risks. This information is for educational purposes only and should not be construed as financial advice. Always do your own research and conduct due diligence before investing in crypto projects.