As the digital revolution marches on, Bitcoin ($BTC) continues to shine, defying skeptics and redefining what’s possible in finance. It’s not just a cryptocurrency; it’s the anthem of a new age—a crazy diamond that keeps illuminating uncharted paths. Let’s dive into the headlines that make Bitcoin the star of the financial stage.

The $100,000 Club

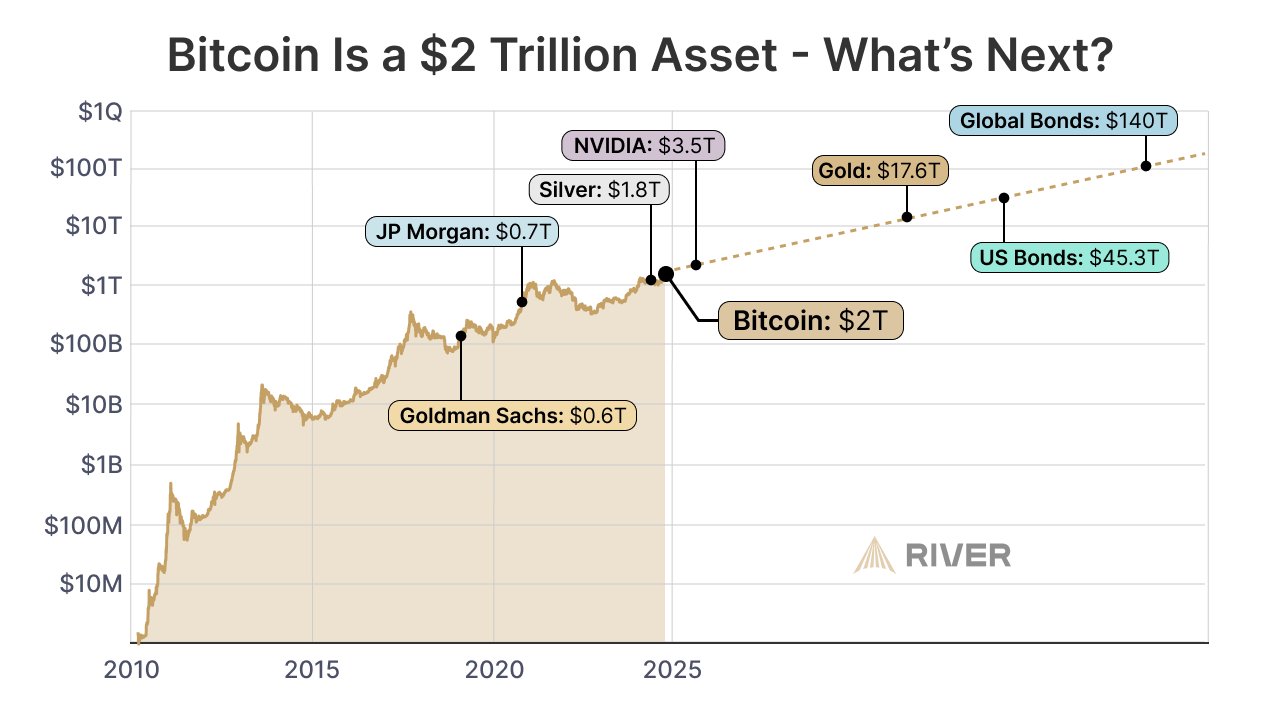

Bitcoin recently hit the long-anticipated $100,000 mark multiple times and came back down, but not too much. These prices are a milestone that transforms $BTC into a $2 trillion asset class, overshadowing silver. This achievement cements Bitcoin’s role not as a fringe experiment but as a core player in global finance. The supply-and-demand narrative supports this rise; spot Bitcoin ETFs in the U.S. recently purchased 28,600 BTC in a week, dwarfing the weekly mined supply of 3,150 BTC. The math is simple: demand is high, and supply can’t keep up.

Source | River

Institutional Waves: Microsoft and Goldman Sachs

Bitcoin has captured the imagination of tech giants like Microsoft. However, its shareholders are still deliberating whether to follow pioneers like MicroStrategy in adding Bitcoin to its balance sheet. On the other hand, Goldman Sachs is going all in, spotlighting crypto as a top theme for institutional investors post-election. Their trading desk now offers everything from CME Bitcoin futures to exchange-traded products. The bank is aligning its strategy with a crypto-friendly regulatory environment, signaling that big money believes Bitcoin is here to stay.

Florida’s $1.85 Billion Bet

Governments, too, are getting in on the action. Florida is setting aside $1.85 billion from its pension fund to create a strategic Bitcoin reserve. This bold move by the fourth-largest pension fund in the U.S. underscores Bitcoin’s growing appeal as a hedge against inflation and a tool for diversification. With pro-crypto leaders like Ron DeSantis championing such initiatives, the Sunshine State is proving that Bitcoin isn’t just a Silicon Valley plaything—it’s a nationwide phenomenon.

MicroStrategy’s Megabuy

MicroStrategy continues to be Bitcoin’s most vocal corporate advocate, with recent purchases bringing its holdings to a staggering 423,650 BTC. At an average cost of $60,324 per Bitcoin, this investment underscores CEO Michael Saylor’s belief in Bitcoin as a superior store of value. It’s not just a bet; it’s a manifesto.

Source | Microstrategy

Amazon’s Potential Leap

Amazon’s shareholders are urging the tech giant to consider Bitcoin investments, potentially making it the next major corporation to embrace the cryptocurrency. If Amazon steps into the Bitcoin arena, it would be a seismic shift, bridging the gap between consumer markets and blockchain technology.

Source | Forkast News

The Big Picture

Bitcoin ($BTC) is no longer an outsider. It’s a central player in the narrative of financial innovation, attracting institutions, corporations, and governments alike. Its rise to $100,000 isn’t just a price point; it’s a cultural and economic phenomenon. Like a diamond, Bitcoin is multifaceted, brilliant, and increasingly indispensable.

For those of you who are new to the game, these articles are not financial advice—they’re merely the opinions of our writer at Millionero, mixed with a ton of facts. Join us in this journey at blog.millionero.com, and if you’re eyeing the crazy shining diamond we just talked about, you can buy it on spot at millionero.com. Let’s shine together!