Hedging is a strategy used to protect against your funds by taking an opposite position in the same asset.

Millionero provides a unique position hedging feature that offers quick protection when the market moves against you. If you find your PNL dropping close to your liquidation price and don’t have the time to manage your position actively, this tool can be an effective solution. Here’s how it works and why it’s beneficial.

What is Position Hedging on Millionero?

Position hedging on Millionero involves locking in the P&L of an existing position by automatically opening an opposite position of the same quantity. This stabilizes the P&L, effectively “freezing” the position and safeguarding it against further market fluctuations.

Why Use the Hedging Feature?

- Immediate P&L Protection: If you notice that the market is moving unfavorably and your position is nearing its liquidation point, hedging locks in your P&L at its current state. This gives you more control and peace of mind.

- Hands-Free Management: For traders who don’t have the capacity to monitor their positions constantly, hedging provides an automated safety net.

- Extended Holding: Unlike traditional methods that may require continual attention, Millionero’s hedging feature can be held for an extended time without extra funding fees impacting your position.

How to Hedge Your Position on Millionero

Step-by-Step Guide:

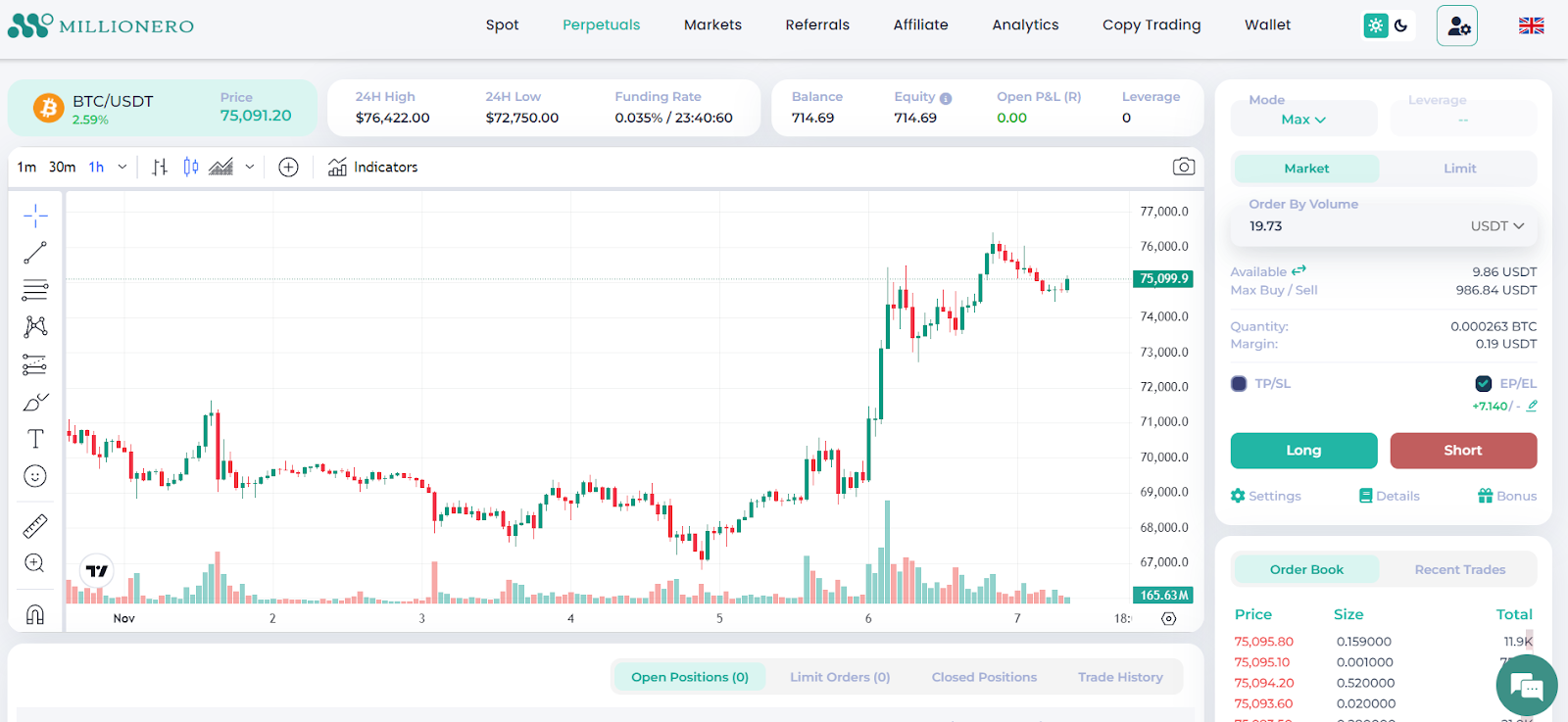

- Access Your Open Positions:

- Navigate to the section displaying your active positions. Here, you can review important details such as entry price and current P&L.

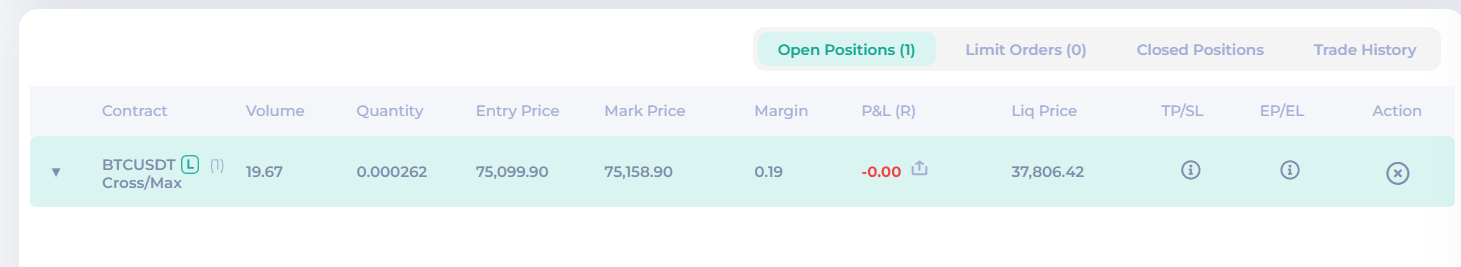

- Select the Position to Hedge:

- Choose the specific position you wish to hedge. This is often done when you foresee unfavorable market changes that could impact your P&L negatively.

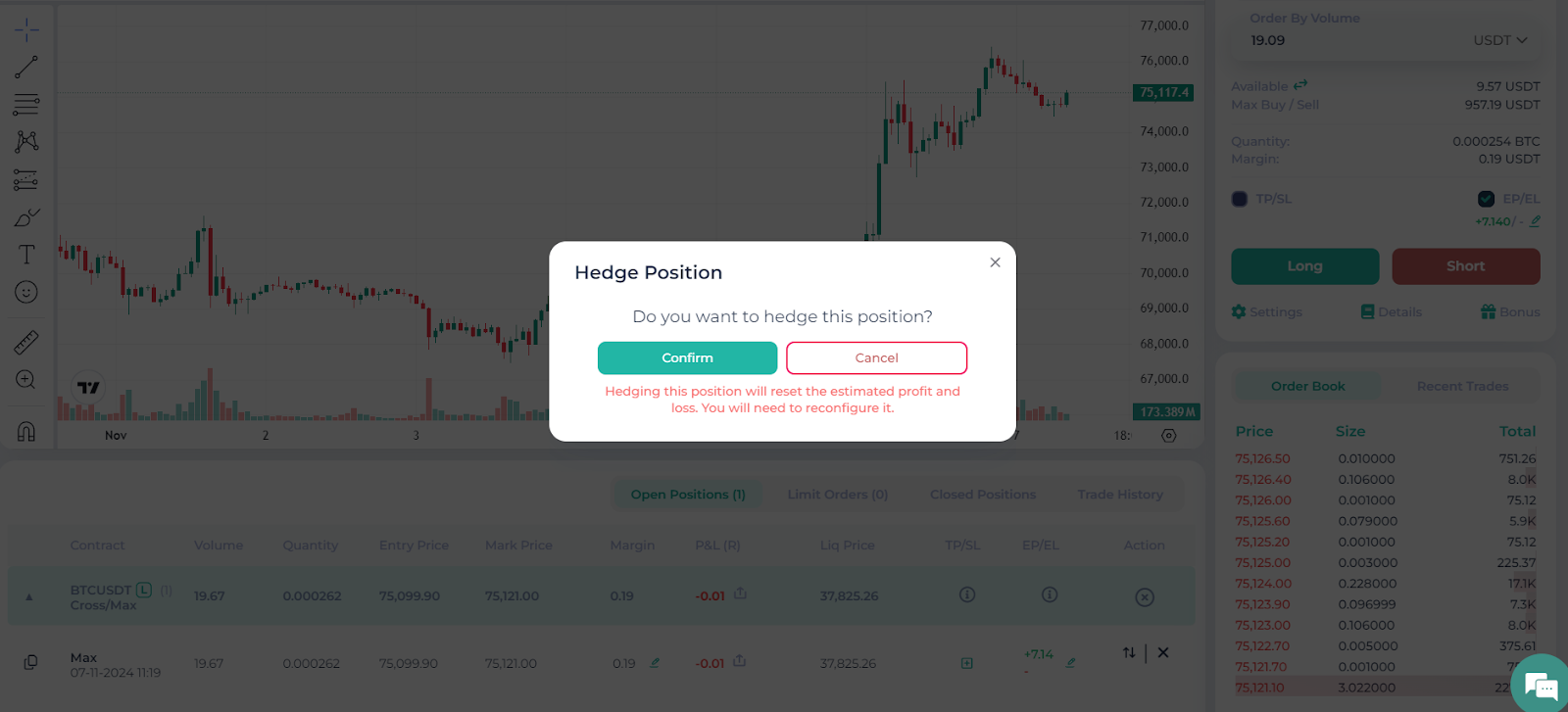

- Initiate the Hedge Action:

- Click on the action icon to open the “Hedge Position” window. This window will prompt you to either confirm or cancel the hedging action.

- Confirm Hedging:

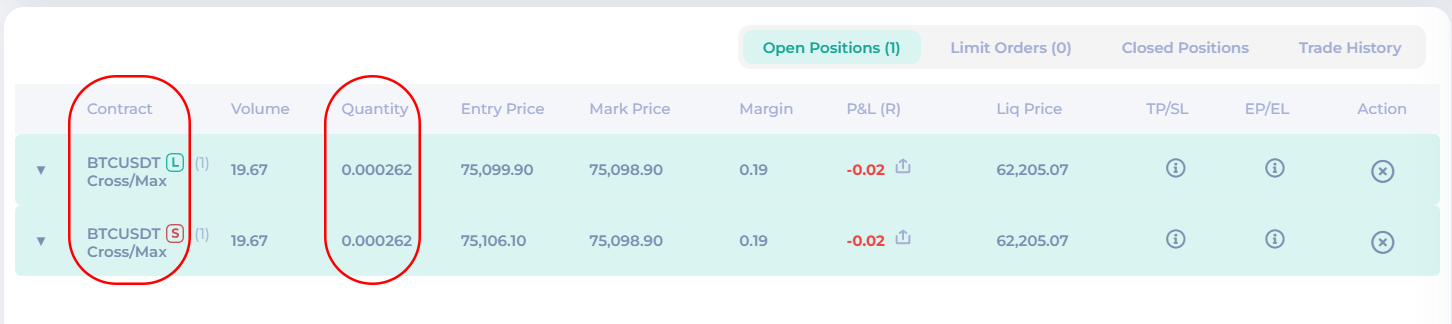

- Click “Confirm” to activate the hedge. Millionero will then open an opposite position for the same quantity. This move halts the ongoing P&L fluctuations, effectively “sticking” the value and preventing further risk exposure.

- Maintain Your Hedge:

- You can keep the hedge in place for as long as needed. The funding rates of the opposing positions will cancel each other out, so your only ongoing expense will be the standard maintenance fee.

Important Note: Initiating a hedge resets the estimated P&L of your position, which means any previous configurations, such as take profit (TP) or stop-loss (SL) settings, may need to be reconfigured.

Benefits of Millionero’s Hedging Tool

- Reduced Liquidation Risk: By hedging, you can prevent your position from being liquidated when the market moves unexpectedly.

- Effortless Management: Ideal for traders who need a quick solution without needing to constantly adjust their positions.

- Cost-Effective: With funding rates canceling each other out between the two positions, you only need to cover the maintenance fees.

Final Thoughts

Millionero’s position hedging feature is a practical tool for managing crypto market volatility. By locking in your P&L, you gain protection against rapid market shifts without the need for continuous oversight. Always consider your strategy and the potential fees before using this feature, and remember to keep updated with insights from blog.millionero.com.