Crypto Bull Run: China recently announced a plan to boost its economy, the biggest stimulus since the pandemic. China’s economy has been very shaky. Growth has slowed, the unemployment rate is high, and the housing market is tumbling.

The move is cited as “the beginning of the end of China’s longest deflationary streak since 1999,” Larry Hu, chief China economist at Macquarie, said in a note.

What’s China actually doing?

- Making Borrowing Money Easier: China’s central bank recently lowered the amount of money needed in bank reserves, approximately $142 Billion less. This means banks have more to lend. This paired with lowering interest rates, making loans cheaper for businesses and people.

- Assisting Homeowners: China’s central bank is giving more attention to mortgage relief to help people with home loans. Around 50 million households might benefit from this relief, giving back over $21 Billion to the people.

- Saving the Stock Market: A $71 Billion program has been introduced to support its struggling stock market. Chinese financial firms can get funding to buy stocks, hoping this will increase confidence in the Chinese stock market.

China’s Policy change, Reflection on US Markets and in turn–on Bitcoin

Commodity prices might start going up. Things like Silver and Copper have already jumped because stronger Chinese markets means factories working more, making more products, imposing higher demands on commodities. This creates stronger competition with other countries’ economies—primarily The US—and demand for Bitcoin might increase for the same reasons demand for commodities might increase. China will have more money to spend on the Shiny New Thing.

Why Bitcoin May Rise: The Impact of Global Liquidity

Bitcoin has a very strong relation with global liquidity. Assets like Bitcoin rise in value when central banks turn on the money printer. We know the US FED just initiated the first of their multiple rate cuts. China is also doing the same. Unlike traditional stocks, Bitcoin doesn’t have other factors like earnings or dividends affecting its price, making it more closely tied to changes in liquidity. A Crypto Bull Run can act as “Pure Barometer of money flow” if global liquidity increases. And we are seeing M2 supply already increasing 🙂.

Source|Macromedia

Trump or Harris?

Source|APNews

This election is crucial for Bitcoin because it will shape how crypto is regulated in the US.

So far, a record amount of money has been spent (in hundreds of millions) by the crypto industry to support politicians who favor friendly regulations. Crypto industries prefer Bitcoin and Altcoins to be under the supervision of a lenient agency like the Commodity Futures Trading Commision (CFTC) rather than the strict SEC and its chairman Garry Gensler.

If pro-crypto candidate (TRUMP) wins, Bitcoin could see more adoption and growth due to more supportive laws. Otherwise, if the crypto-skeptical and suffocatingly cautious wing (Harris) wins, they will probably enforce more strict rules on the crypto industry. Needless to say, 2024 election will play a pivotal role in the timing of the upcoming bull-run.

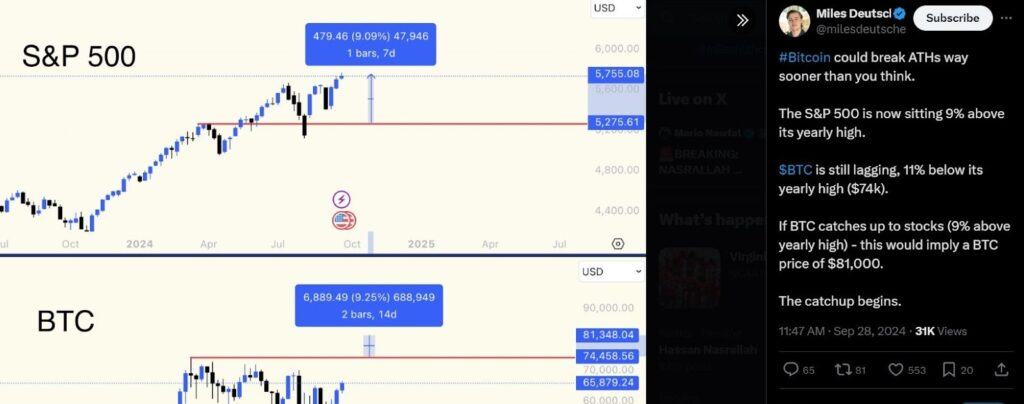

Bitcoin Set to Break All-Time High—Following SP500

@Milesseutcher, a prominent crypto figure on twitter suggests a valid point.

Since Bitcoin closely follows the NASDAQ and SP500, it could reach new all-time-high prices sooner than expected. He points out that SP500 is 9% above its highest point the year, while $BTC is 11% below yearly-high of $74k. and believes if or when $BTC catches up to SP500, it would reach a price of approximately $81k. He implies that we are at the start of this rally.

You Should Already be Prepared for this Bullrun. DYOR and Not Financial Advice

In essence, a mix of China’s economic actions, rising global liquidity, the upcoming US presidential election, and current market trends has set the stage for this bullrun. The Earthquake has happened. We are just waiting for the tsunami of good fortune to hit us 😀