The week had several optimistic events lined up for the crypto industry in regulation and adoption while the market stayed resilient with soaring prices.

The crypto industry witnessed an extremely encouraging week. The market began the week on a strong note and sustained its gains. The monetary policy meeting by the Federal Reserve in the US further boosted crypto token prices with the rate pause. Analysts are currently significantly bullish with their crypto price predictions. Bitcoin, Ethereum, and a bunch of other tokens fared well in the crypto bull run.

Meanwhile, there have been several updates in the crypto industry on regulation. Countries like Taiwan and Turkey have progressed with their respective crypto regulatory plans. Central banks have also made headway in testing central bank digital currencies (CBDCs). The spotlight for the week was on Hong Kong with the conclusion of the first stage of its CBDC pilot program.

Private corporations like Visa and Standard Chartered have been prominent partners of the CBDC program. On the other hand, Mastercard tied up with a private crypto firm to upgrade its blockchain payment infrastructure. Crypto payments have especially been figuring on top priorities for traditional payment firms recently. It could probably indicate improved sentiments for the potential of the crypto sector.

For instance, PayPal also procured a license in the UK this week for crypto services. The Financial Conduct Authority in the UK said, “This includes, but is not limited to, ceasing on-boarding new customers and restricting existing customers to hold and sell functionality.” Such licenses to global crypto firms could go a long way in expanding crypto adoption worldwide.

Regarding regulations, the pending crypto ETFs in the US created a significant stir in the crypto market this week. Experts predicted a huge capital inflow with the crypto ETFs, but their final approvals still lie with US regulators. Stakeholders in crypto have been hopeful for an early launch of the crypto ETFs, which could, in turn, benefit the industry.

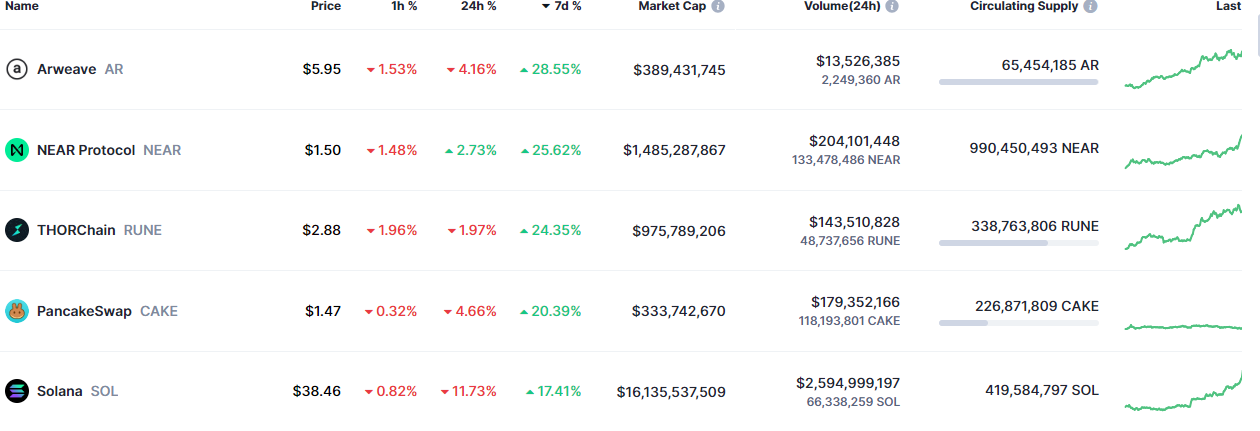

The latest crypto market data on November 3 indicates the following tokens have been the top five performers in the week:

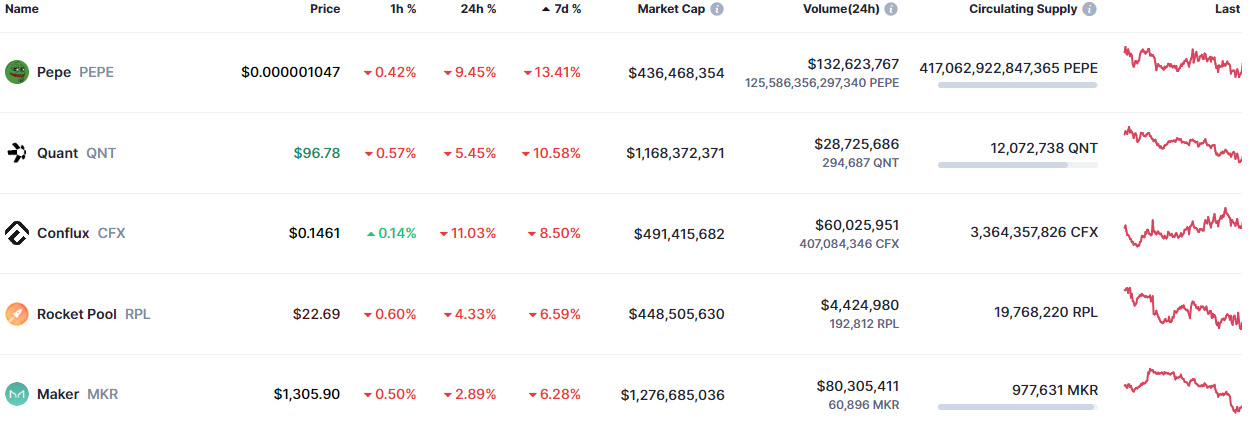

On the other hand, the following five tokens were the worst performers for the week:

Solana has been one of the best-performing tokens, with returns far higher than even Bitcoin and Ethereum. SOL rose to a fourteen-month high, with over 17% returns this week alone. It is currently trading at $38.55, with a market cap of around $16 billion. Several reasons could be responsible for the price hike. Capital inflows into Solana-based funds have surged. The Solana upgrade also witnessed a tech upgrade recently, which could have contributed to the rally.

Further regulatory and market developments in crypto could depend on central banks’ actions and the macroeconomic climate.

Follow Millionero for all the latest crypto news and updates regarding the market!