The critics of the crypto market always have one criticism for it – that of huge volatility in the crypto market. And they are not wrong. However, there are ways you can benefit from this volatility. Enter crypto scalping – the art of making quick profits from short-term price fluctuations.

To scalp crypto, traders rely on a toolkit of indicators that can provide valuable insights. In this guide, we’ll understand in depth what is scalping in crypto and discuss the best crypto scalping indicators.

What is scalping in crypto?

Crypto scalp trading is a high-frequency crypto trading strategy that involves executing numerous trades within a short period, aiming to profit from small price changes. Unlike traditional day trading, which holds positions for several hours, scalpers hold their positions for mere seconds or minutes.

Scalpers use the volatility of the crypto market by identifying and exploiting temporary price discrepancies. They rapidly buy and sell cryptocurrencies, trying to accumulate small profits from multiple trades.

It’s a high-risk, high-reward strategy that demands quick decision-making, technical expertise, and a deep understanding of market dynamics.

Top crypto scalping indicators

Let’s discuss the best indicators for crypto scalping:

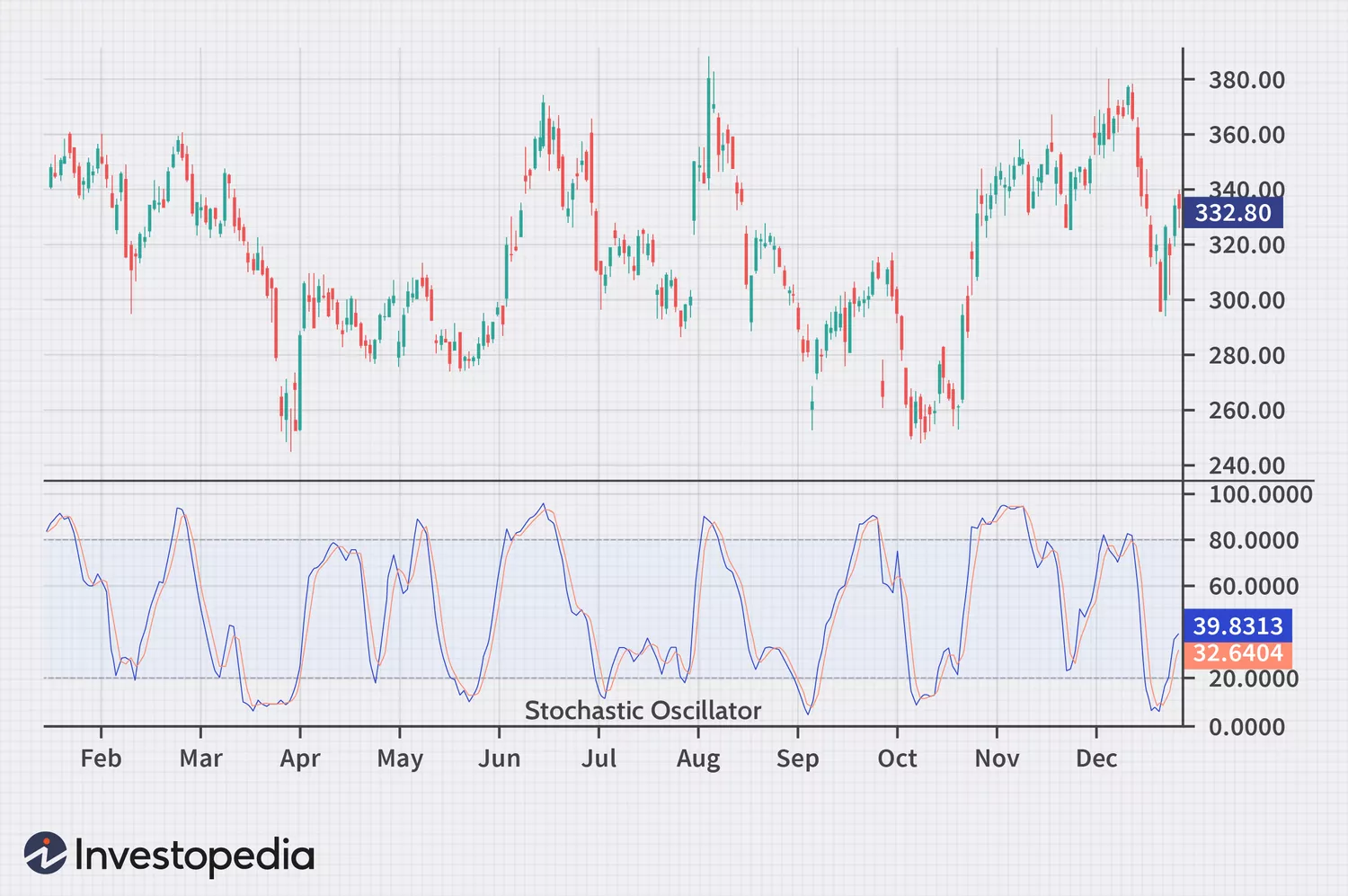

Stochastic Oscillator strategy

It is a momentum indicator that measures the closing price of a crypto relative to its price range over a period. By identifying potential overbought and oversold conditions, traders can anticipate trend reversals.

How it works:

- The oscillator consists of two lines: %K and %D.

- The %K line reflects the closing price’s position within the recent price range.

- The %D line is a smoothing of the %K line.

Trading signals:

- A crossover of the %K line above the %D line in an uptrend suggests a buying opportunity.

- A crossover of the %K line below the %D line in a downtrend indicates a selling opportunity.

- Readings above 80 indicate overbought conditions and those below 20 suggest oversold conditions.

Moving Average strategy

Moving averages are fundamental tools in a scalper’s arsenal. By smoothing price data, they help identify trends and reversal points.

How it works:

- Simple Moving Average (SMA): Calculates the average closing price over a period.

- Exponential Moving Average (EMA): Gives more weight to recent prices, making it more responsive to market changes.

Trading signals:

- A price above a moving average indicates an uptrend, while a price below it suggests a downtrend.

- The intersection of two moving averages (e.g., a 50-day and 200-day SMA) can signal trend changes.

These are lagging indicators, which means they react to price changes after they occur. Combining them with other indicators can improve accuracy.

Parabolic SAR Indicator strategy

It is a trend-following indicator that identifies trend reversals. It plots dots above or below the price, depending on the trend direction.

How it works:

- Upward trend: SAR dots are plotted below the price.

- Downward trend: SAR dots are plotted above the price.

Trading signals:

- Buy signal is generated when the crypto price moves above the SAR dots.

- Sell signal is generated when the crypto price moves below the SAR dots.

The SAR indicator can be a valuable tool for scalpers, but it’s essential to use it with other indicators for better accuracy.

Relative Strength Index (RSI) strategy

It measures the speed and change of crypto price movements. It helps identify overbought and oversold conditions.

How it works:

- RSI oscillates between 0 and 100.

- Readings above 70 indicate overbought conditions, while those below 30 suggest oversold conditions.

Trading signals:

- Traders look for divergences between price and RSI, or for RSI to reach extreme levels before entering positions.

Remember: RSI is a momentum indicator and can generate false signals, especially in ranging markets. Combining it with other indicators is advisable for improving accuracy.

Factors to consider when scalping crypto

Keep these factors in mind before you begin scalping crypto:

- Market dynamics: Prioritize cryptocurrencies with substantial trading volumes to ensure smooth trade execution. Short-term price fluctuations are the lifeblood of scalping, so choose assets with a history of rapid price movements.

- Time frame selection: Shorter timeframes (1-minute, 5-minute, or 15-minute charts) offer more frequent trading opportunities but require rapid decision-making. Align your timeframe with your trading style and risk tolerance.

- Risk management: Scalping inherently involves risk. Implement strict stop-loss orders to limit losses. Determine a suitable risk-to-reward ratio and adhere to position sizing guidelines. Avoid over-leveraging to protect your capital.

- Psychological preparedness: Scalping can be emotionally demanding, especially if you’re starting out. Develop strategies to manage stress and avoid impulsive decisions.

Scalping demands a unique skill set and mindset. By mastering how to read charts and understanding diverse trading tactics, you can become better at your craft.

New to crypto trading? Place your bets on Millionero

Venturing into the world of trading cryptocurrencies can be daunting, especially for beginners. Millionero offers a user-friendly platform designed to simplify the trading experience. With a clean interface, access to a wide range of cryptocurrencies, and features like copy trading, Millionero caters to both novice and experienced investors.

Whether you’re looking to build a diverse portfolio or learn from seasoned traders, Millionero provides the tools and resources to help you achieve your crypto goals.

Disclaimer: Cryptocurrencies are an inherently volatile asset class, and investments can carry substantial risks. This information is for educational purposes only and should not be construed as financial advice. Always do your own research and conduct due diligence before investing in crypto projects.